You should never sell Bitcoin. Time and time again selling Bitcoin in exchange for fiat currencies has again proven to be a poor investing decision. This article dives into why you should never sell and some alternatives to selling from the standpoint of the everyday investor.

It is the dream of most investors to buy an asset like Bitcoin at a low price and see the price appreciate to incredible values and live the dream as a multi-millionaire.

But is selling your Bitcoin for of US dollars (or some other fiat currency), for real estate, lambos, or any other thing a good strategy?

Timing the Bitcoin Market

In order to successfully sell your Bitcoin, you need to both buy Bitcoin and sell at very particular moments in time. In hind sight, this seems far easier than the reality of the situation.

Bitcoin is volatile when priced in USD or another fiat currency. We’ve seen various “bubbles” form over Bitcoin’s 13-year history.

The price goes up and to the right, only to spectacularly crash down to a percentage of the highs. Here is a link to my article going deep into the timing and structure of the Bitcoin Bubbles.

Many newcomers to Bitcoin (myself included at one point in time) will think to themselves, “if I can time the market and buy low and sell high and I can make a fortune!”

After these corrections, Bitcoin has inevitably come back to make higher highs each exponentially higher than before. Each time investors kick themselves for selling and missing out on the future gains.

Consider the tale of Bitcoin pizza day, in which Laszlo Hanyecz spent what is billions in today’s dollars on two large pizzas in 2010. Thousands of stories like this exist.

The opposite is also true. Thousands have bought bitcoin at all-time highs, only to sell the low when they read the latest CNN article declaring Bitcoin to be dead.

Humans are not very good at investing, and even worse at trading.

To Trade Bitcoin or to Never Sell Bitcoin?

For the sake of argument let’s see just how hard it is to sell Bitcoin “at the top.” As previously noted Bitcoin gained popularity and notoriety through a series of spectacular bubbles.

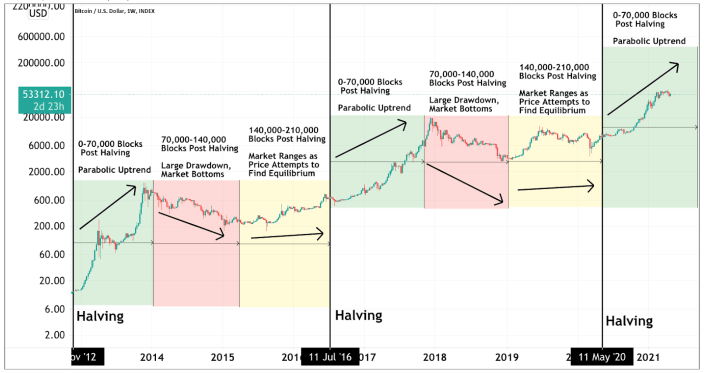

Perhaps not so coincidentally these bubbles have corresponded to programmatic changes in the Bitcoin protocol that cut the mining reward in half every 4 years. This “halvening” creates shifts in supply and demand that drives price upwards and to the right! Bitcoiner’s comically call this “number go up technology.” Consider the chart below from Bitcoin Magazine.

Problem #1 – Finding a profitable entry point

Buying at the bottom requires conviction. In order to have a conviction on a stock or an asset like Bitcoin, you need to believe in the product.

While everyone is writing Bitcoin obituaries you need to do the opposite and be aggressive! This is not an easy task. You will be by very definition going against the trend and the market sentiment.

I was blessed to have gained enough knowledge of Bitcoin through the 2018 bear market to know that 2019 was a great time to buy. It wasn’t a popular decision at the time. Everyone thought the bubble had burst and Bitcoin was dead. History proved them wrong.

Investors had a 17 week period and a chart that looked like the above 1.1. Does this chart suggest all-in on Bitcoin?

Let’s rewind to the previous halving cycle.

During the 2015 bear market investors had a longer 37-38 week period to buy between $150 and $250. That seems like all the time in the world!

However, at the time there was no such thing as the 4-year cycle. Bitcoin was in an 80% drawdown and trading back and forth will little news, publicity, and advocates. There was no “bitcoin twitter” at this point in time, no stock 2 flow model, and certainly no Bitcoin on corporate and nation-state balance sheets.

For anyone saying, I wish would have put my life savings in Bitcoin at $300, probably wasn’t there ready to hit the buy button. Fear dominates bottoms and buying at the bottom takes some guts.

Bottom line – Bitcoin is hard to buy at the bottom

Problem #2 – Selling the Top

While fear dominates the bottoms of the market, when selling on the top you need to fight the power of greed. Greed is a powerful force. During the 2017 bull run, no one in their wildest dreams imagined Bitcoin running up to nearly $20,000.

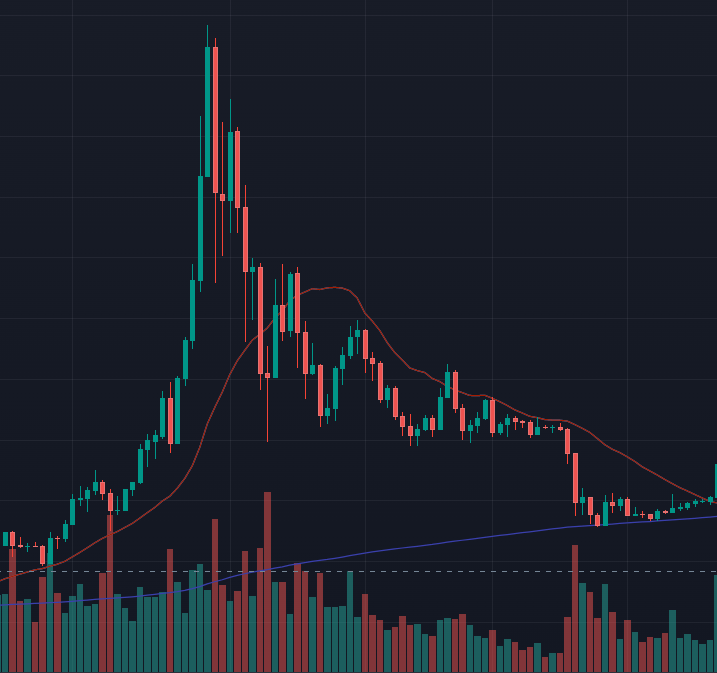

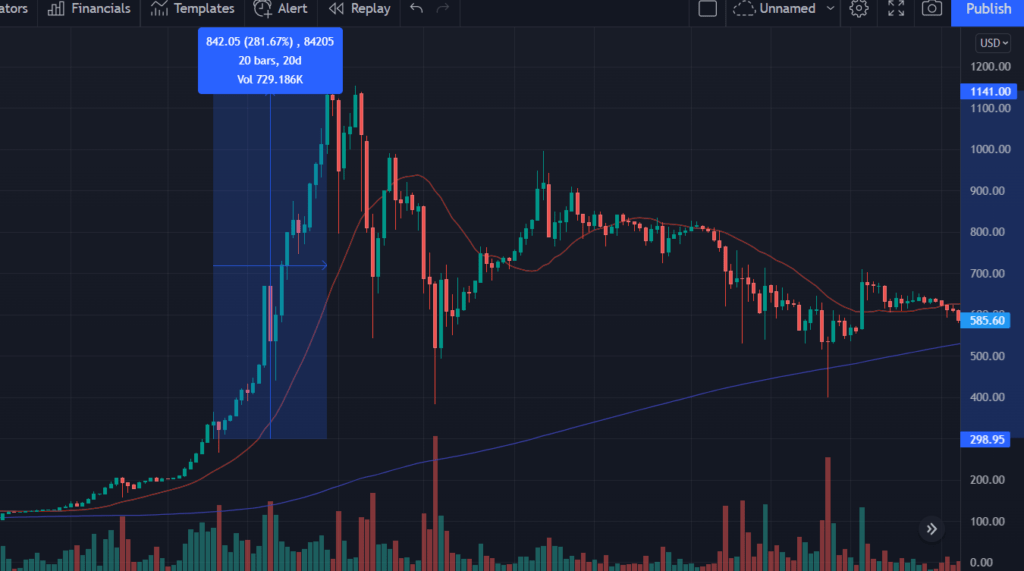

Before the Bitcoin top, the price doubled IN 14 DAYS.

4 days later, the price took a nose dive back down to $11K and some change. There wasn’t a tremedous amount of period to enjoy this massive price rally.

I remember being on a business trip during this period frantically checking my portfolio on my phone unable to pay attention to the meeting I was attending. Fun times.

The cycle of 2013 was even worse!

The price of bitcoin spectacularly rocketed from around $200 to over $1,100 in 20 DAYS! Only then to proceed to lose 50% of its value as speculators won and lost fortunes.

Bottom Line – Bitcoin is hard to sell at the top

Problem 3 – Taxation (US)

According to the Internal Revenue Service Bitcoin is treated as personal property when either converted to other digital currencies or sold in exchange for US dollars or any other good or service.

Please note if you do not live in the United States, your tax rate will likely be different. I get visitors to my site from all around the world, please do your own research.

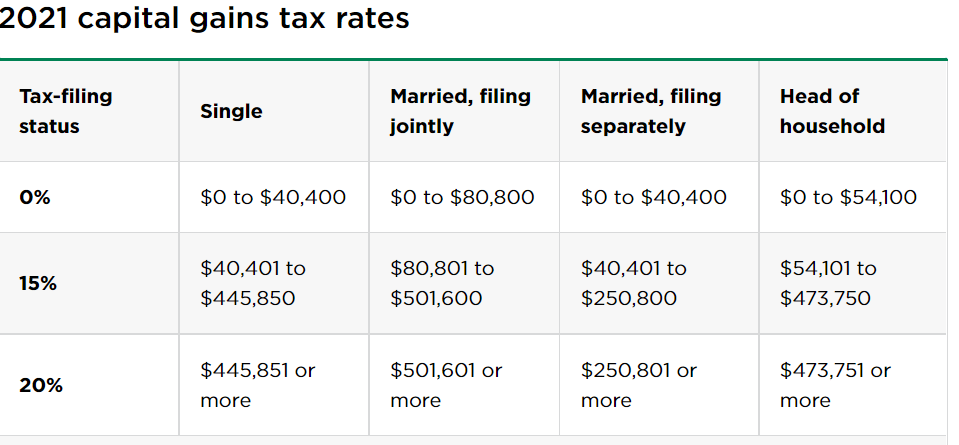

Bitcoin is subject to the same capital gains tax as stocks and other assets. Therefore, if held in the short term of under a year it will be taxed at the same rate as your income. If held for over one year, Bitcoin sales will be taxed between 0-20% depending on your income level. See chart below.

In addition, if you live in a state that has a capital gains tax you will likely face a hefty bill on your “sick gainz.”

Let’s imagine after hodling over a 4-year cycle you witness the market top. At the market top your gains were right at $1,000,000.

At this point, it is very hard to decipher between a violent pullback and the beginning of a bear market. Being a good trader you want to let your winners run and cut off your losses short.

After the next sell-off, you decide to sell, because you don’t want to endure 2 years of a bear market. Keep in mind you would be a very talented trader because as mentioned prior it is difficult to tell the difference between a 30% dip and the beginning of a bear market. Bitcoin regularly drops 30% during violent bull markets.

At this point, if you cashed out you would have nearly $700,000 in gains. This will result in a net gain of $490,000 after an estimated 30% of taxes. Ouch.

Now applying that to history let’s say this all took place over the 2017-2019 bull-bear market. Our trader had 50 Bitcoin, which he hopefully had acquired less than a year from the top.

This means that the trader would take home the equivalent of selling at approximately $9800 assuming a zero-cost basis.

Was it worth cashing out and paying taxes?

At the bottom of the bear market, this investor would have faced a painful 80% drawdown with his 50 Bitcoin valued at roughly $190,000 USD. The pain would have lasted about 19 weeks but the total amount of bitcoin remained at 50.

Today, that 50 Bitcoin would be worth approximately $2,425,000, with a peaked value of $3,500,000.

Was the 19-week painful drawdown worth the forgoing of the $490,000?

Would the investor have rebought at lower prices? The conviction here would take more discipline than most, especially if that $490,000 is a meaningful amount.

For that, we must ask the next logical question….

What are selling your Bitcoin to buy?

Never sell Bitcoin for ______________.

The fundamental question the personal investor needs to ask when confronted with the thought of selling his or her Bitcoin position is “What am I exchanging this bitcoin for?”

The stunning obvious answer for the majority of investors in US dollars (or fiat currency of choice) or cash. Yes, sit back and glory in the enormous cash position you have accumulated! Now what? Perhaps build a money bin like Scrooge McDuck?

Let’s talk about the considerable alternatives and circumstances in which one might consider selling their Bitcoin position.

Circumstances to (potentially and likely foolishly) Sell

Selling Bitcoin for A Place to Live

Everyone needs shelter and I would argue a decent shelter comes before the opportunity for massive generational wealth. How big or grand of a house you need is up for debate.

I would suggest that selling Bitcoin for the purpose of purchasing a home to live is a reasonable circumstance to part with some coin. Real estate generally goes up in value and can serve as an investment and improve the quality of your life.

HOWEVER, there are a few strategies for selling Bitcoin for real estate –

- Only use Bitcoin for the down payment. Borrowing in fiat while saving bitcoin has proven to be a very lucrative trade. Fiat is garrenteed to go down in value making your loan more affordable over time.

- If possible, do not sell your bitcoin, incurring a tax burden. Instead use it as collateral for your down payment. More on using Bitcoin as collateral for a fiat loan below.

- If you must sell bitcoin, sell during a period of market euphoria.

Selling Bitcoin for Trophies

It is well known in Bitcoin and cryptocurrency that when the price pumps up, the sales of Lamborghinis also pump.

Trophies are fun. Trophies help us self-actualize who we want to be and can mark significant accomplishments with material proof of work. Boats, exotic cars, fashion, and many other depreciating assets fall into this category.

Trophies are also ego-driven, hedonistic, and often depreciate rapidly.

I hate to break the bad news bros, but selling Bitcoin to afford yourself a nice trophy is almost always a bad idea. Keyword almost….

You’ve gotta live your life right? Here are some practical circumstances that may be worth parting with some Bitcoin.

- You have no children, significant other, or heirs in your life and believe you don’t have more than 5-10 years to live. One could argue that hodling bitcoin sustains the viability of the network for years to come. You’ve also got to live a little.

- You’ve reached financial freedom and no longer need to work for a living and are willing to spend no more than 1-2% per year of your entire Bitcoin protfolio on the trophy.

Many Bitcoiners have found themselves becoming far less materialistic as they realize departing with their Bitcoin will likely equal a less lucrative future. Read more in my article on Bitcoin and Minimalism.

Selling Bitcoin to Buy More at a Lower Price

If you are a super trader with insane discipline and knowledge of the market that exceeds 95-99% of market participants, more power to you.

In our example above our trader that had 50 Bitcoins could have taken his $490,000 in profit and reinvested at $3,800 for 128 Bitcoin.

While this sounds like an amazing idea, if you are not right every time, you will likely end up spending more money and ending up with less Bitcoin and more trading fees.

Selling Bitcoin to Retire

Perhaps you want to quit your fiat job. If you quit your job and that is your only source of cash flow you will need money for living expenses.

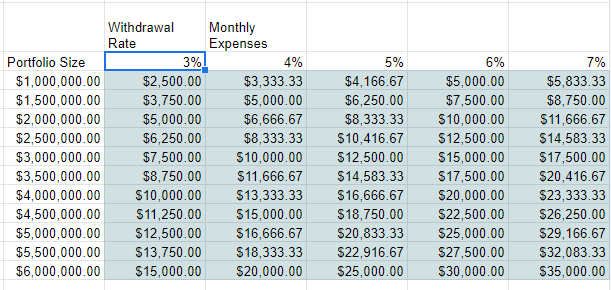

Enter the 4% withdrawal retirement rule.

This rule states that if you withdraw 4% or less from your traditional asset portfolio you will historically never run out of money. Given a rate of return at approximately 7-10%, you’ll continually have money to live on while you siphen on 4% per year for living expenses.

With the 4% rule, if you spent $100,000 per year, you would need a portfolio of $2,500,000 to retire comfortably.

Bitcoin’s 10-year history has produced over a 150% return per year. However, these great returns have also come with periods of downwards volatility.

Assuming Bitcoin continues to succeed and attract more value into the digital asset, it would be safe to assume that a 4% withdrawal rate would be a safe bet. The Bitcoin retiree would simply sell what they needed for living expenses while not exceeding 4% of their entire portfolio in a year.

Depending on either your propensity for gambling or confidence in Bitcoin price appreciation the Bitcoin retiree could theoretically either retire with a smaller portfolio or feel free to withdraw more than 4%.

However, with sky-high inflation rates, this rule is quickly changing. I exercise caution to the would-be retiree during this period as living costs are rapidly rising.

The good news is that Bitcoin should respond favorably to rising inflation. Bitcoin is a bit funny as it behaves like a risk-on asset and trades with the stock market at times. We’ll see how the market treats Bitcoin as inflation continues.

Read my future article on retiring with Bitcoin coming soon

Selling Bitcoin for Diversification

The entrepreneur’s mantra

“Concentrate to create; diversity to protect”

Diversification is a defensive investing strategy in which the investor spreads their wealth over various categories, industries, and geographies.

Some investors even talk about diversification into various cryptocurrencies and atlcoins in order to diversify their portfolios. Please read Jimmy Song’s article, “Why Cryptocurrency Diversification Makes Little Sense.”

Many altcoin enthusiasts will aruge that their lower market cap altcoin will likely rally with Bitcoin and a greater % of appreciation. If you invested in Doge coin at the beginning of 2021 to May 2021, you would have been able to purchase each coin for under and penny and cash out around 70 cents.

If you can successfully time an altcoin boom and bust and make a fortune, only to convert that fortune into more Bitcoin than if you had invested in Bitcoin directly, congradulations you did well. However, this path isn’t advisable and picking the right coins is a huge gamble.

Very few altcoins have successfully survived and performed well over longer periods of time. There is no doubt that massive returns can come from altcoins, but the risk is extremely high and the trading is even harder than with Bitcoin.

To move into alts as a diversification strategy would be rather like investing like an Angel Investor or Venture Capitalist planting seeds in many projects likely to fail and even supporting harmful scams.

Does it make sense to diversify into other assets such as real estate, stocks, bonds, gold and other more traditional assets?

Bitcoin has proven itself to be the best performing asset over the 13 years of it’s existence. There are no signs of it slowing down. It is likely Bitcoin will continue to be the fastest horse in the race for the foreseeable future.

Part of the reason Bitcoin will continue to dominate other investments lies in the fact that Bitcoin is emerging as a store of value, medium of exchange, AND most importantly a UNIT OF ACCOUNT.

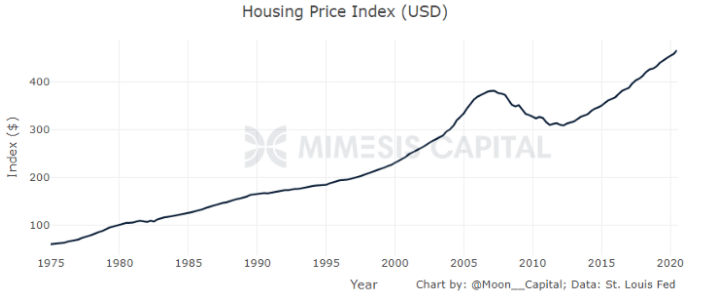

Most investments are denominated in their countries fiat currency. If you buy a house in Turkey it will be priced in Lira. If you buy a house in India you think in Rupees. Not unlike Bitcoin a large part reason for the recent sucess in asset classes such as real estate is these investments also disporportionally benefit from the rampant inflation and money printings we’ve seen recently.

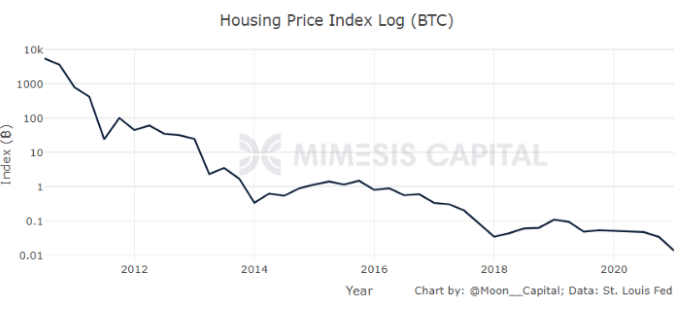

Using Bitcoin as a unit of account we can see that alternative assets are falling in value in comparison to Bitcoin.

Now housing priced in Bitcoin. Keep in mind this is a log chart.

Compare Bitcoin to any asset in the last 10 years and you will find that all other asset classes continue to collapse when using Bitcoin as your unit of account.

Until we begin to see Bitcoin as a standard unit of account with scale and stability in the not-so-distant future, it is hard to make a case for diversifying a portfolio into other assets.

Selling Bitcoin for Art, Collectibles, and Other Assets

Bitcoin shares a lot of characteristics with art and other rare and scarce assets. The scarcity of items such as a painting from Salvador Dali will remain valuable because there will never be another created and they exhibit beauty, skill, and something aesthetic.

Art is an excellent investment, but art lacks the demand that humanity holds for Bitcoin. Bitcoin enables property rights that cannot be confiscated for the entire world and enables individuals and organizations a secure place to hold and transfer wealth.

Although art has a limited supply, the demand for art will always be more limited than investments that solve multiple problems. Bitcoin solves bigger problems for the world and will therefore have much higher demand.

Earning Interest on Bitcoin

Love it or hate it, the financialization of Bitcoin is happening. This has resulted in Bitcoin borrowing and lending services from companies such as Blockfi, Salt, Unchained Capital, Holdnaut, Nexo, and Ledn. Hodlhodl even offers the ability to borrow and lend directly peer to peer without a custodian. I expect we will see the number of companies offering these kind of services grow as the network expands.

These companies have created the ability for Bitcoin holders to earn interest on their Bitcoin as they lend their bitcoin out for a return. Returns on Bitcoin generally fluctuate between 1-5% in annual yields.

The hardcore Bitcoiner is generally against the financialization of Bitcoin and these products as they force users to give up full control of their Bitcoin for a small percentage yield. Philosophically, this goes against the Bitcoin ethos and combines modern banking practices such as rehypothecation and fractional reserve lending. On the other hand, it would be difficult to stop banks from participating in these activities and if they are making money off of it, perhaps you should too! Read about some of the risks here.

The argument against Bitcoin rehypothecation, is that with Bitcoin’s programmed hard cap ultimately limits excessive rehypothecation.. Rehypothecation is limited because the institution rehypothecation will eventually shoot themselves if they overdo it. Bitcoin is both decentralized and auditable. The entire blockchains enables you to keep track of all transactions and keys since the beginning of Bitcoin’s creation. Bitcoin’s hard cap acts like a sheriff for these rehypothecating institutions. Anyone caught being too risky with customers’ funds would certainly find themselves in a world of trouble very quickly.

Nevertheless, investors need to consider the risk when lending their Bitcoin. On the other side of the transaction, there is a party that is all but guaranteed to be profiting from your borrowed coins. There is also transactional risk and exchange risk that could see you losing your Bitcoins altogether. Is a modest annual yield worth the potential risk of loss? Here are some strategies for earning interest on your coins.

- Only risk what you can afford to lose

- Keep the majority of your Bitcoin in cold storage

- Spread lending across different platforms to minimize exchange risk

- Understand the trade offs

One of the reasons I like holdhold’s model is that there is no intermediary scalping a profit. The inherent security of cryptography enabled multi-sig contracts allowing parties to continue to hold their own keys in an escrow account. I expect this type of peer-to-peer lending will grow within the Bitcoin ecosystem as technology continues to make financial intermediaries obsolete.

Using Bitcoin as Collateral

The last option but certainly not the least is using your Bitcoin as collateral for borrowing fiat money. Many of the same companies mentioned above offer Bitcoin collateralized loans.

In this scenario, the borrower pledges their Bitcoin and lets the digital asset bank hold onto their funds. In return that individual can borrow fiat currency. This allows the investor to continue hodling their Bitcoin while using some of the value they have gained through appreciation.

The price the investor pays is typically an interest-only rate of approximately 5-10% (depending on the loan to value of the assets). These loans have typical payback periods of 1 or 2 years and can be rolled over in perpetuity.

If you believe the price of Bitcoin will continue to rise greater than the interest payment, savvy investor can increase the velocity of their investments by creating more value for their borrowed funds.

Consider a home flipper that uses Bitcoin collateral to make 20% returns on real estate investments.

This investor is gaining income from their hodling as the price of Bitcoin appreciates, and making an additional 20% from their housing flip, while paying 10% on their loan.

If the price of bitcoin goes crashing down, the borrower will need to put more Bitcoin into the loan as they receive a margin call. With the inherent volatility of bitcoin, this clearly presents some risks. Here are some strategies to consider.

- Only use very low loan to value ratios. If the price of Bitcoin fluxuates you will have plenty of space before a margin call.

- Have a solid investment or spending plan for the money

- Research if borrowing from other sources such as home equity makes more sense

- Understand the trade offs

The Future of Bitcoin Lending and Borrowing

While the current environment for Bitcoin presents some risks, I believe the future will hold incredible opportunities for those that want to continue holding their Bitcoin while tapping into the power of their collateral for business activities.

Digital asset company Ledn, is working on a product that allows customers to use a combination of Bitcoin collateral and mortgage collateral to borrow funds. You can finance using Bitcoin as collateral to buy a new property or you can finance property you already own for more cash.

In the words of billionaire and famed Bitcoin investor Michael Saylor, “Bitcoin is THE pristine collateral.” Trading your Bitcoin for inferior forms of money or other property doesn’t make sense. As more and more recognize the power of this new technology it will form the base layer of all trading and financial interactions.

Selling Bitcoin after Hyperbitcoinization

There may come a time in the distant future when everything is priced in Bitcoin and Bitcoin has become the base reserve layer for all transactions. In this world, many will still choose to save in Bitcoin.

“Selling” Bitcoin will happen every time you buy a coffee.

Since Bitcoin is deflationary in nature, the price of goods and services compared to consumers’ savings will generally go down. In a hyperbitcoinization scenario, the value of bitcoin will stabilize and serve as a unit of account across all markets.

I believe savers will store wealth in Bitcoin, but investors may wish to take on more risk for the sake of higher returns. For this purpose, investors may lend their Bitcoin to businesses for the sake of creating more value. Since storing in Bitcoin itself will bring steady increases to purchasing power as value is continually created throughout an economy, investors will take fewer risks with their capital and invest more prudently.

Bitcoin will force large corporations, governments, and other entities into honest and prudent capital management. The 21 million Bitcoin hard cap and network secured by decentralized power will ensure that those not honest in their dealings will face free-market consequences.

The interim period between a completely hyperbitcoinized world and where we are now will be a very exciting one. This will be the world we see Bitcoiners build the infrastructure that takes civilization to new heights.

Bitcoiners will begin to build, using their massive purchasing power to build infrastructure for the new world of peace and prosperity. The new infrastructure will need pioneers in the world of law, architecture, philosophy, and engineering.

Conclusion – Never Sell Bitcoin

It is very hard to find a case for selling Bitcoin.

We’ve seen it is very difficult to trade bitcoin, even over large periods of time. Bitcoin’s historical booms and busts have produced profitable trading opportunities, but they are difficult to predict and capitalize upon.

The severe taxation and continual upward momentum in Bitcoin clearly display that the most opportunity historical opportunities to sell became a poor decision in hindsight.

Every investor needs to answer the question “what should I sell my Bitcoin for?” Unless you are in a dire situation, there are very few situations that make selling Bitcoin a profitable investing decision.

The landscape for earning interest and taking out a loan collateralized with Bitcoin is slowly taking shape and offering investors some interesting options. While the space is not without risks, the future will likely see some excellent options that will allow Bitcoin holders to continue holding while utilizing their capital. Never sell Bitcoin.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

2 responses to “Never Sell Bitcoin. Why you should Hodl on Forever.”

Great content! Keep up the good work!

Thank you! Appreciate the comment.