I remember the days well. It was near the end of 2015 and I was just getting into Bitcoin. I had been accumulating a little Bitcoin here and there around the price of $200-$300 US dollars.

Then suddenly in November, the price jumped up to a little over $500 per coin! This was the first indicator I was on to something. This was a game-changing technology.

I kept accumulating.

Then things got a little weird.

In 2016 the price of Bitcoin hovered around $500-$700 the whole year. It felt like an eternity. I made a few trades during those days, but every-time I had the same thought:

“Is the price of Bitcoin too expensive?”

Keep in mind, I wasn’t one of the Bitcoin O.Gs that bought for under $30.00 in 2012, 2013, and rode out a couple of bubbles.

Plan B, on Twitter, had not released the Stock-to-Flow value proposition for Bitcoin. There was no such thing as a 4-year cycle based on the increasing scarcity programmed into the model.

At the time not many people were talking about Bitcoin at all. News about Bitcoin could not be found on major financial websites you’d have to find specialty sites like Coindesk or Cointelegraph.

Of course in hindsight, I wish I had bought more(public service announcement: I am not the first Bitcoiner to say this), but at the time it felt like a real risk.

The one thing that was clear was adoption was growing.

Adoption was the main factor I thought about when considering my investment. Imagine being an early adopter of technologies like the pc, mobile telephones, and the internet.

Like these inventions, Bitcoin is a technology that stands to benefit the early innovators and early adopters in the space. With prior inventions like the PC, one would have benefitted from it by investing in companies like Microsoft or Apple.

One could invest in companies in the Bitcoin space. However, Bitcoin is decentralized without an over-ruling company or person in charge of the protocol.

The easiest and most direct way to invest in this technology is by trading currency (or another item or service or value) to acquire it.

The more adoption we witness with Bitcoin, the higher demand we have for it and thus a higher trading value. All technologies are said to take on an S-Curve of adoption over time seen in the image below.

The question is where are we in the adoption of Bitcoin?

My belief is we have recently crossed the Innovator stage and are passing into the Early Adopter phase.

S-Curve of technology adoption

The Satoshi

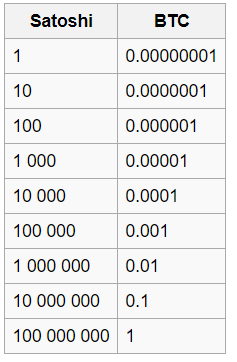

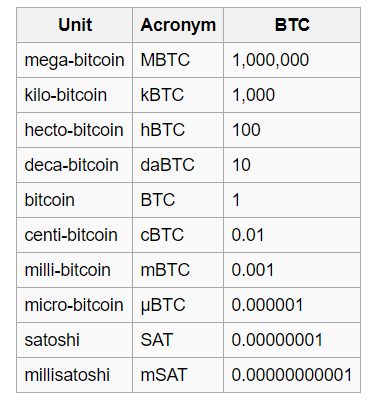

Bitcoin can be divided into 100,000,000 smaller units called Satoshis. See the table below.

Likewise Bitcoins can be grouped into larger and and theoretically smaller groups. Although it would take a collaborative decision from the Bitcoin miners to approve of a unit smaller than the Satoshi.

One aspect of the protocol that can never change is the maximum total Bitcoin which stays fixed at 21,000,000. The total quantity of Bitcoins that can come into existence cannot be altered.

It follows that the total amount of Satoshis is fixed at 21,000,000,000,000,000. You do not need to buy an entire Bitcoin, any exchange will allow the user to purchase any centi-bitcoin, milli-bitcoin, micro-bitcoin, etc.

A popular phrase in the Bitcoin community is to keep “Stackin’ Sats”, loosely translated “to continually acquire small amounts of Bitcoin.”

“Buying Bitcoin”

To say you going to “buy Bitcoin” like a stock purchase is a bit of a misnomer.

It is more accurate to say you converted your fiat currency into Bitcoin.

Although in the United States, Bitcoin has been ruled a commodity like soybeans, gold, or oil and is taxed with capital gains tax when transacted. Many have erroneously compared Bitcoin to collectibles like Beanie Babies. Bitcoin does reflect some of the qualities of stores of value like art, gold, Rolex watches, fine pianos, and other assets that reliably store of value. However, in its short existence, it has also experienced some wild price swings making the store of value case weaker.

The reality is when you are “buying” Bitcoin you are exchanging units of your favorite fiat currency for a technology-based currency protocol.

As a speculative investor in Bitcoin, you are making a bet on this technology and see the utility in its systemic security and decentralized protocol.

Bitcoin serves as an asset that increases and maintains value as more and more people recognize it to be a revolutionary technology with beneficial qualities.

Back to our original question, is Bitcoin Expensive?

The answer to that question depends on if you believe that the demand for the Bitcoin protocol will increase or decrease.

We know that the supply of Bitcoin is pre-programmed into the protocol to be reduced over time. We will talk about the supply side of the equation in a future article. Since we know the supply side of the Bitcoin equation, we must look to the demand side to assess whether Bitcoin is currently expensive.

Demand for Bitcoin

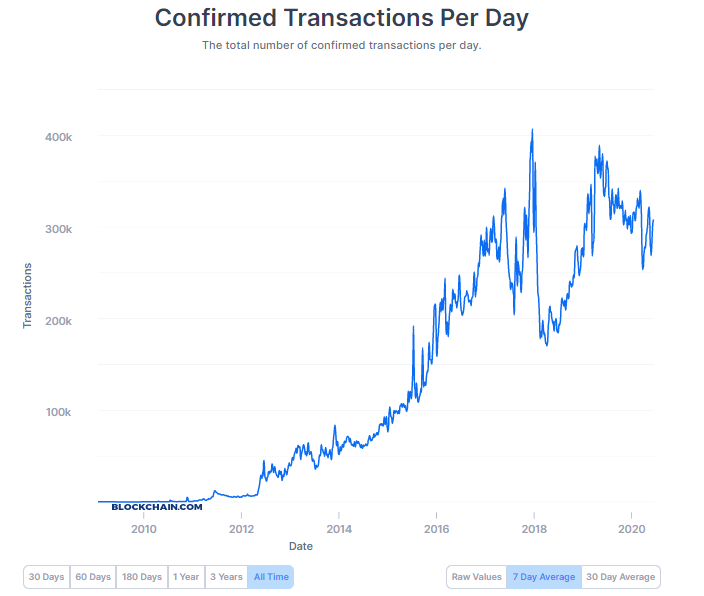

A good place to start for assessing the demand for Bitcoin is in actual transactions. Transactions show us how much the network is being used and growing in popularity over time.*

As you can see from the chart below, the amount of confirmed transactions has dramatically risen over the past 8 years. In 2020, on any given day the typical amount of transactions is usually around 300,000 regardless of the size of the transactions.

Another gauge of demand is the number of Bitcoin wallets and estimated total Bitcoin users.

Since one of the main use cases of Bitcoin is to essentially save or store value in the technology, total transactions do not tell the entire story.

It is extremely difficult to estimate how many Bitcoin wallets are in existence and how many have been in existence.

One individual user may hold many wallets (I have probably created over 20). Many wallets may have very little or zero Bitcoin in its contents. However, here are some statistics I found on the web.

- There are over 50 million wallets created on blockchain.com

- Coinbase claims over 30 million users

- Popular exchange Binance has over 15 million yearly users

- According to a survey about 11% or 30 million US residents own Bitcoin

- Europe boasts 37 million Bitcoin users or about 5% of the population

- Worldwide, it is estimated that 1.3% of the population owns Bitcoin*

Despite what I would consider an unexpectedly large number of Bitcoin wallets and users, most Bitcoin holders share a relatively small amount of Bitcoin.

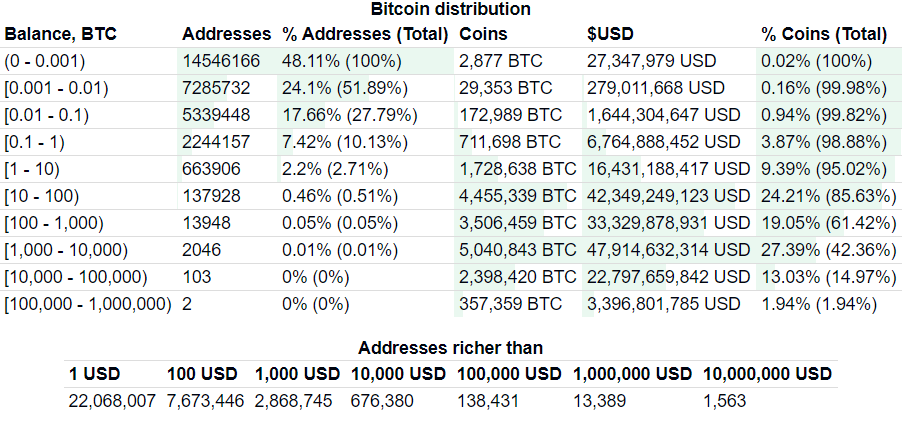

Take a look at the Bitcoin Rich List (updated daily https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html). Here is data from 6/16/2020:

Here you can clearly see that over 97% of Bitcoin wallets hold less than 1 Bitcoin.

Additionally, the largest Bitcoin wallets belong to 2046 addresses with the 10,000-100,000 BTC. Many of these addresses are said to be wealthy individuals, institutional holdings, and cryptocurrency exchanges.

HODLers

Whether it is the appeal of potential sensational gains, the desire for a new more fair currency system, or a hedge against fiat currency inflation, Bitcoin holders revel in the volatility of the asset.

These long term holders call themselves HODLers or Hold-On-For-Dear-Life during the currencies historic rises and falls.

HODLers pride themselves in resilience during downtrends in price holding on to an intense belief in the long term value proposition of Bitcoin.

HODLer activity has been on the rise as analysts report that Bitcoin wallets with more than 1 BTC are on the rise.

Institutional Demand

Financial Institutions have expressed record interest in Bitcoin in the year 2020.

Cryptocurrency Hedgefund Greyscale reports that from January to March 2020, institutions have invested more than $443 million into the space accounting for 88% of inflows.

Legendary hedge fund manager Paul Tudor Jones recently claimed interest in Bitcoin and encouraged a minimum of 1-2% of net worth invested in the asset. Read more about the growing institutional interest here.

Conclusion – A Short Story about Bitcoin Pizza Day

May 22nd 2010, Bitcoin Pizza Day, has become something of a holiday in the Bitcoin world. Bitcoin Pizza Day marks the day that the first commercial Bitcoin transaction took place.

Laszlo Hanyecz paid 10,000 Bitcoin for 2 large Papa Johns Pizzas.

Hanyecz reportedly bought two so he could have some leftovers for the next day. Nine months after the purchase, Bitcoin reached parity with the U.S. dollar, making the two pizzas worth $10,000 and in 2015 — the fifth anniversary of Bitcoin Pizza Day — the two pizzas were valued at $2.4 million.

Today, just over ten years later, the two pizzas would be valued at around $94 million.

With all this in mind, is Bitcoin expensive, or the deal of a life time?

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research

*https://www.blockchain.com/charts/n-transactions

*https://www.buybitcoinworldwide.com/how-many-bitcoin-users/

*https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html