A quick browse of the internet will yield you thousands of articles on stocks vs real estate for Investment. We are in the year 2020, and there is a new contender in town. This is the epic guide to the latest asset showdown Bitcoin vs real estate for investment.

A few ground rules before we begin looking at these investments side by side.

We will be comparing investments from a personal finance perspective.

We won’t be discussing careers in real estate or working as a full-time real estate investor/flipping houses/ BRRRR Strategies etc.

Likewise, on the Bitcoin side, we won’t be discussing working in the blockchain space. becoming a core developer, or any other special strategy that resolves around employing your own labor to add value.

Although there could be a tremendous amount of value in these more involved strategies, they won’t be useful for our comparison of these assets.

We will be looking at these investments from the standpoint of a passive investment.

Additionally, as we square off Bitcoin vs real estate investment strategies, we are going to assume that we are the average personal investor.

An investor with millions or billions in net worth is going to think differently about asset allocation, wealth custody, and asset management.

Alternatively, someone like a college student just getting starting with investing with only a few thousand dollars to invest will inevitably think differently about risk management.

As we compare the old school real estate to Bitcoin, the new kid on the block we are going to take a look at the following categories that investors may look at to strategically increase their net worth.

Leverage – Bitcoin vs Real Estate

Real Estate – One of the main advantages of real estate that investors have the ability of using leverage to multiply their returns.

Lenders recognize that the value of real property has served as a stable place to store value and generally appreciate over the long term. This allows the real estate investor to use other people’s money and lever their financial position as they purchase properties.

In general, real estate investors can expect to require a down payment of 20% in order to secure a property. The rest of the value of the property can be mortgaged as debt for the investor. Let’s look at the math.

Purchase Price of a Home – $226,800 (2019 Median Home Price)

Down Payment – $ 45,360

Mortgage Debt – $181,440

Our average property investor only needs $45,360 to leverage themselves ownership of a $226,800 asset.

This type of leverage is a very powerful tool in wealth creation. Let’s imagine our real estate investor’s property appreciated 10% over a period of time.

Value of home – $249,480

Investor’s total equity = Appreciation of $22,680 + Down Payment $45,360 + Any Mortgage Payoff

Investor’s Total Return = 50% ROI + Any cash flow generated by the property – Expenses

The previous example displays how powerful leverage can be for increasing wealth. While the home increased in value 10%, our investor was able to received a 50% return on investment.

Bitcoin – Can investors take advantage of leverage when investing in Bitcoin?

The simple answer is – Yes. But, I wouldn’t recommend it.

The use of leverage in Bitcoin is typically reserved for the purpose of short term trading. Many cryptocurrency exchanges will allow qualified accounts to trade Bitcoin and other cryptocurrencies with leverage ranging from 5X all the way up to 100X.

A house purchased with a 20% down payment represents a 5X amount of leverage. Imagine how insane a 100X purchase would be. Here is an example.

Current purchase price of Bitcoin – $10,000

A trader believes in the short term Bitcoin will rise to $10,500 before it goes to $9,500.

The trader is willing to bet $2,000 on this move, but only has $10,000 in his trading account (unless this guy has some insider info, he is recklessly stupid and will eventually lose all his money, read my article on trading here. unless your winning percentage is extremely high a 20% position size will most likely leave you bankrupt very quickly. I reccomend a positions size which risks no more than 1% of your capital if you must short term trade).

This trader could only afford 1 Bitcoin but that would only profit him $500. So if he is really convinced of this price move he’d have to use leverage.

Using a leveraged trading account our “investor” here uses 4X leverage to buy 4 Bitcoin at $10,000.

If the price goes up to $10,500 – Score, he makes $2,000!

If the price goes down to $9,500 – Darn, he is out $2,000!

You can see here how the volatility of the asset matters. In general, the price of real estate has remained relatively stable over the last hundred years.

The ten year price history of bitcoin has been rife with 50-80% drops.

Using leverage in Bitcoin is an extremely dangerous game and could be likened to winning the lottery.

Is it theoretically possible to use leverage at the right time, buy at a bottom, and watch your investment increase 5,000 fold over a short period of time? Yes, but a highly unlikely and not sustainable strategy.

Exchanges see where the leveraged positions are and publicly post their net long and net short leveraged positions.

Large whales (institutions or high network traders) will actively search the market for opportunities in either direction (long or short) to squeeze traders out of their positions.

These large traders move the market forcing smaller accounts to liquidate their positions, while they pick up more Bitcoin or sell during a peak of market euphoria.

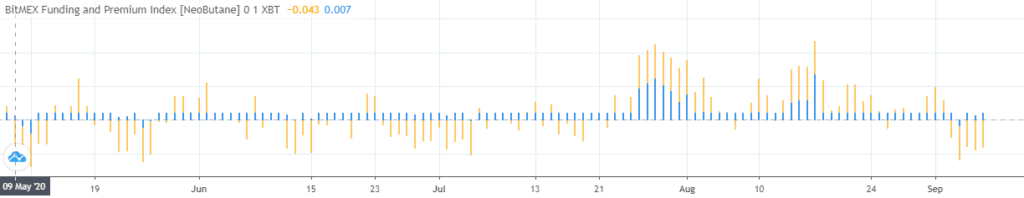

In the image above you can see the Bitmex Funding Rate indicator for Bitcoin. Historically it has proven that the crowded side of the trade (most leveraged trader are long or short) is most often wrong.

Unless you are a highly skilled trader with specific strategies and incredible money management practices, the use of leverage in Bitcoin is a mistake.

For the long term Bitcoin investor, the potential gains are far large enough without the use of leverage.

Bitcoin Vs Real Estate Using Leverage Winner – Real Estate

Taxes – Bitcoin vs Real Estate

Real Estate – Real estate has long offered investors an advantage over other long term investments when it comes to taxes. Real estate offers excellent tax benefits via –

- Depreciation

- Interest Deductions

- Deductible Expenses Related to Managing Properties

Depreciation – Real estate investors have a huge advantage of being able to deduct the depreciation of the value of their rental units over time.

As a property grows older and the building begins to wear and tear the value of the property goes down. Known as depreciation, this allows investors to realize this loss over time to reduce their taxable income.

Residential rental properties have a useful lifetime of 27.5 years that investors can deduct. Commercial properties can be depreciated over 39 years.*

Investors are only able to depreciate the value of the buildings or improvements built on the land. Investors are not permitted to depreciate the value of the land.

Let’s say an investor purchase a house for $226,800. The land is worth $26,800 (to make the math easy).

Our investors is able to depreciate the remaining $200,000 value of the property over 27,5 years.

This means that this investor can reduce their total taxable income by $7272.72 per year.

Depreciation is an extremely powerful tool in the real estate investors toolbox.

Deductible Expenses – Real estate investors can deduct any expenses related to the business of managing their rental property.

- Property management

- Maintenance

- Utilities

- Property Taxes

- Expenses related to obtaining and retaining tenants

- Travel expenses to and from your rental properties

- Points paid to obtain your mortgage

- Insurance expense

- Cleaning fees

- Legal fees related to this business

All of these expenses can be deducted from the revenue generated by a property to reduce the taxable income.

For example –

Yearly Rental Income $30,000

Expenses of obtaining a tenant -$2,000

Cleaning fees -$1,000

Legal fees -$500

Property Management -$3,000

Total taxable income from property $23,500

Both depreciation and deductible expenses can be used together to further the investor’s savings.

In the above example, the investor would be able to take subtract an additional 7272.72 from the $23,500 to bring the taxable income from the property down to $16,227.28

Mortgage Interest Deduction – the last powerful tax advantage you can take advantage of with real estate investment is a deduction of your mortgage interest.

Real Estate Investors can deduct mortgage interest for an unlimited amount borrowed for a property.

This deduction only applies to the interest paid on the loan not the principle loan amount.

When applying to an investment property the mortgage interest is deducted as an expense from the income produced from the rental.

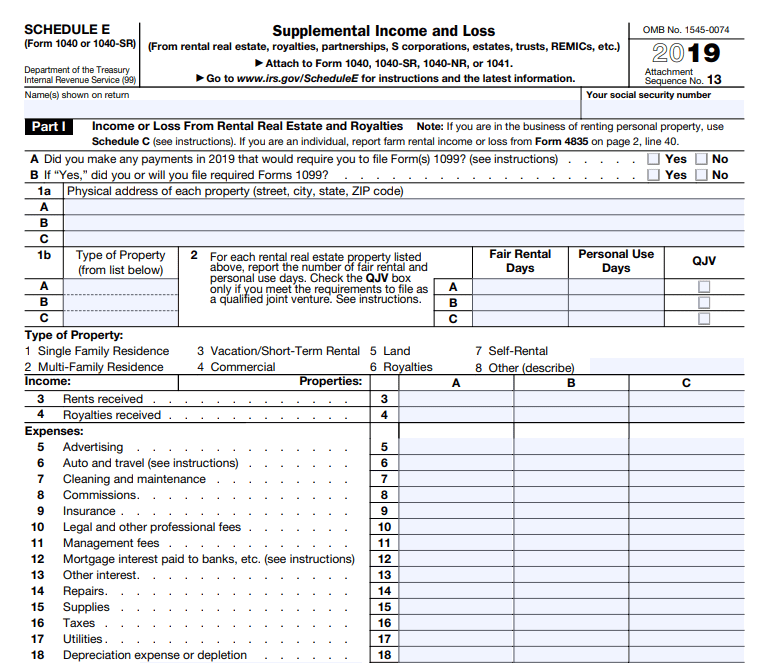

Mortgage Interest is deducted just like other expenses on schedule E in the United States.

Mortgage interest expense is extremely favorable as it can significantly reduce your taxes owed while increasing your net worth as your property appreciates in value.

Bitcoin – Bitcoin has often been mistakenly accused of being a tax haven for investors. However, taxes on Bitcoin are a real thing and shouldn’t be underestimated.

In 2014 the IRS released details in regard to the taxation of virtual currency. Bitcoin and all other cryptocurrencies would likely be considered under the designation of “virtual currency.*

To the US government, virtual currency is considered property and taxed as such.

The summation of how Bitcoin and cryptocurrency is taxed comes down to this quote from the IRS –

In general, the sale or exchange of convertible virtual currency, or the use of convertible

virtual currency to pay for goods or services in a real-world economy transaction, has

tax consequences that may result in a tax liability.

IRS

Note in the previous paragraph that suggests any “exchange of virtual currency or the use of.”

This infers that any exchange of a cryptocurrency for another cryptocurrency or fiat currency would incur a taxable event.

It would also suggest that using Bitcoin or another cryptocurrency to purchase a good or service could also result in a taxable event.

According to the IRS any transaction in Bitcoin must be reported in US dollars. Any payment or exchange that occurs must use the fair market value of Bitcoin in US dollars on that date.

For example. An investor buys 1 Bitcoin at $10,000. Bitcoin appreciates $12,500 and they decided to cash out in USD. The investor will need to pay capital gains tax on the $2,500 profit.

In a similar situation, one less favorable for investors, let’s suppose the same investor decides they want to invest in Ethereum rather than take a vacation.

At the value of $12,500 the investor converts their BTC to ETH. This transaction also incurs the same capital gains tax.

I’ve heard rumors that some lawyers in the space are arguing that this constitutes a 1031 like-kind exchange. This tax advantage allows investors and businesses to exchange similar types of assets without a taxable event.*

However, from everything I’ve researched this rumor is not an established law yet. Be on the safe side and don’t risk it!

Bitcoin is taxes as a capital gains tax.

The US divides up capital gains tax into short term and long term. Short term capital gains are defined as assets held for under 1 year and long term is over the 1-year mark.

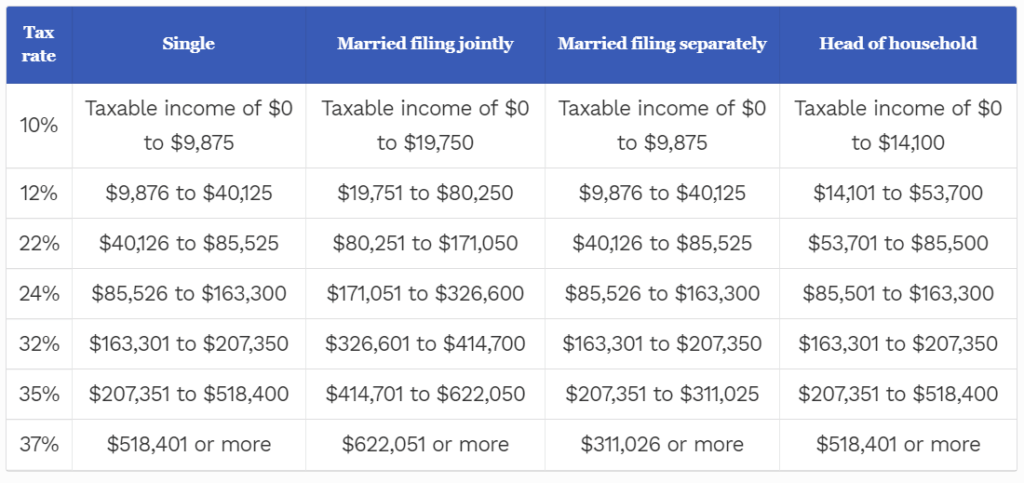

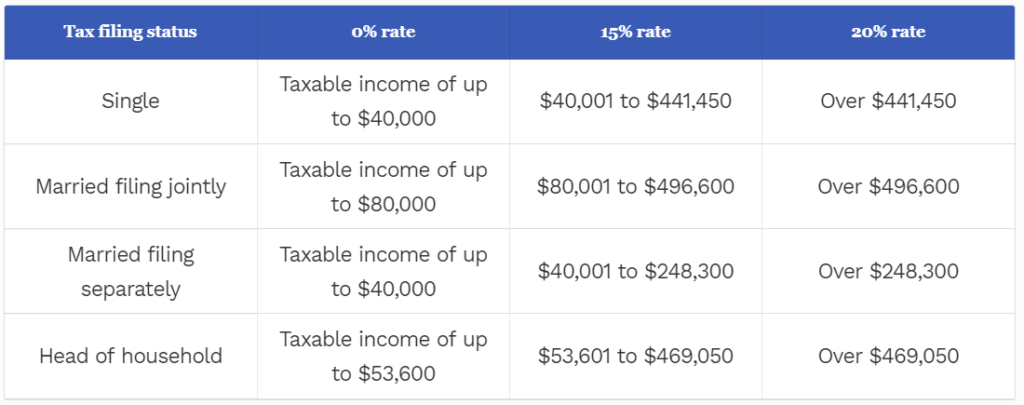

Short term capital gains tax incurs a far greater tax burden than holding your assets for longer. Short term capital gains are taxed on top of your income. See the tables below.

For a top earner, this could mean the difference of 17% tax or a total of 37% of your gains will be owed to the Federal Government upon selling Bitcoin.

As you can see from the tables above it definitely pays to hold Bitcoin for over a year.

The good news is that Bitcoin appreciation alone is not a taxable event.

If you Hodl your Bitcoin and it increases in value, you will not be taxed unless you decided to sell or exchange it.

There is talk in the Congress of a passing a Bill that would make small transactions performed with cryptocurrency under a certain value nontaxable events.

This Virtual Currency Exchange Act of 2020 is being looked at and seeks to make transactions less than $200 a non-taxable event. This would be a huge victory and a positive step toward cryptocurrency adoption in the US.

Bitcoin vs Real Estate Tax Advantages Winner – Real Estate

Historical Performance – Bitcoin vs Real Estate

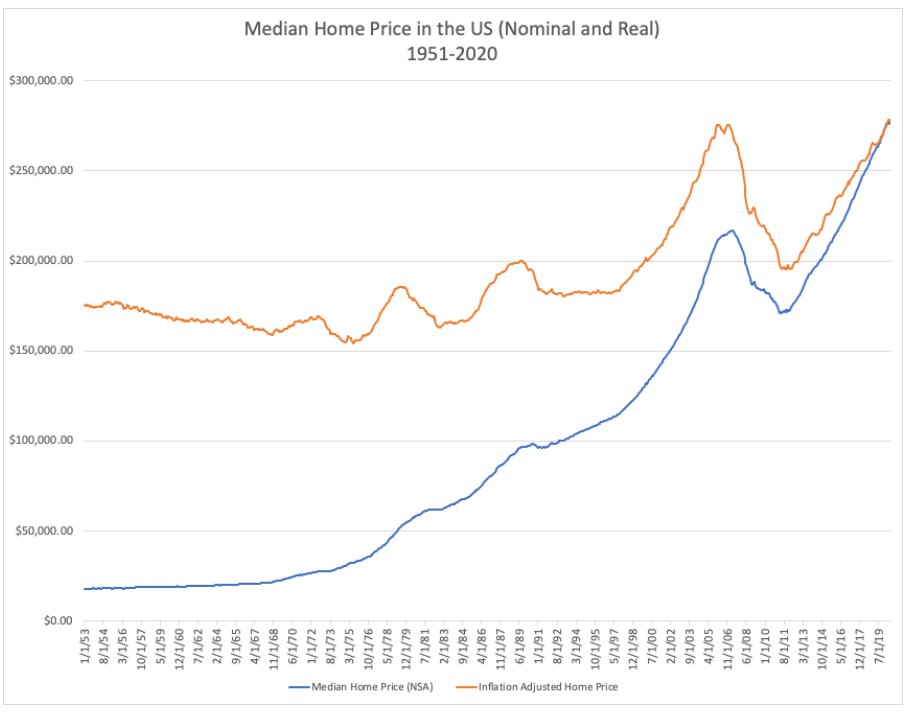

Real Estate – According to the Case-Shiller Housing Index, the historical rate of return for real estate in the US between 1928 and 2013 averaged 3.7%.*

Sounds like a stable investment right?

Maybe not, after you adjust real home prices for inflation the result is not quite as favorable.

Imagine you bought a residential property in 1990. Although the value would have likely risen a little. You would have seen a decline in purchasing power from the value stored in your home until the early 2000s!

This also doesn’t account for hot housing markets. Hot housing markets in growing areas can drive capital appreciation through the roof!

Supply and demand can drive the prices of housing up and down just like everything in the economy. As you can see from the info-graphic there are several distinct factors associated with supply and demand that can influence prices.

Take a look at markets like San Francisco, New York City, and Los Angeles in the last 30 years. There was an explosion in wealth that came directly from real estate appreciation.

How the post-COVID-19 pandemic will affect future real estate prices is uncertain. My bet is that the pandemic will provide short term panic and medium-term buying opportunities in desirable cities to live in.

Bitcoin – If you are reading this blog, there is a good chance that you have heard about the rise and rise of Bitcoin.

Bitcoin has risen faster in the last decade with a greater magnitude than virtually any asset ever.

Bitcoin’s historic rise from 2009 to 2019 is said to have appreciated nearly 9,000,000%.* That is a million percent….

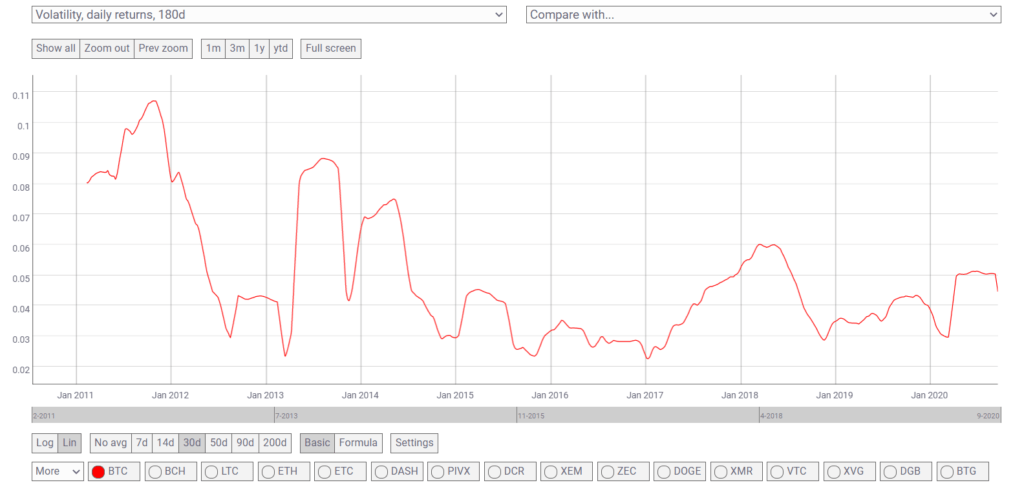

The Bitcoin price has followed a series of dramatic price bubbles. Although the total value put into Bitcoin continues to increase, the overall volatility in the system is steadily decreasing.

This combination of the rising price compared to other assets while decreasing in overall volatility creates a powerful picture of Bitcoin adapting into a mainstream financial investment.

As the financial disclaimer goes, prior performance does not predict the future. If Bitcoin continues to expand into a world renowned asset class, we will likely see more of this dramatic price appreciation. I believe this sets up Bitcoin as a tremendous asymmetric risk profile.

Bitcoin vs Real Estate Historical Performance Winner – Bitcoin

Cashflow – Bitcoin vs Real Estate

Real Estate – One of the most attractive aspects of owning real estate is the ability to earn relatively passive income.

I remember getting my first rental check in the mail from my property in Santa Ana, California. There is nothing like the feeling of earning money while providing the service of shelter for others.

There are other types of investments that provide cash flow such as bonds, dividends and peer to peer lending. However, Real Estate combines tax benefits, appreciation, leveraged debt pay down, and cash flow on a monthly basis.

These combined benefits provide real estate investors with the best of many worlds.

What kind of cash flow can you expect from a real estate investment?

Real Estate investors look at a metric called Cash on Cash return when determining whether an investment has good cash flow.

Most investors agree that 8-12% typically represents a good cash on cash return.

Cash on cash is essentially the money you made from your net income (rental income minus expenses) divided by the cash put down to make the deal. For example.

- Purchase Price: $200,000

- Down Payment: $40,000

- Mortgage: $160,000

- Annual Rental Income: $24,000

- Annual Expenses: $12,000

- Annual Mortgage Payments: $4,000

Net Income from Rental $4,000

Cash on Cash Return = Net Income $4,000 / Down Payment $40,000 X 100 = 10% Cash on Cash

In many property markets across the US you’ll find that higher appreciation areas often have lower relative rents.

Likewise in higher rent areas you often won’t experience much price appreciation.

While this is by no means a hard rule that can’t be broken, it’s often the case.

There are advantages and disadvantages to buying to maximize either cash flow or appreciation. Cash flow is definitive. Appreciation can be speculative.

Investing for cash flow can be a slow process of gaining wealth. Meanwhile investing to maximize appreciation can see incredible leveraged gains.

A more comprehensive way to look at a real estate investment is for the overall investment return or IRR Internal Rate of Return.

If you plan on selling your real estate investment in 5 years and you anticipate price appreciation. The Internal Rate of Return would estimate your net overall gain in terms of a percentage.

When looking at an investment deal if you can generate something in the vicinity of 12-15% overall yearly return on your investment, you did very well! Here is an example.

Let’s assume our investment appreciated at a rate of 3% per year for 5 years.

| Purchase | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Sold |

| -$40,000.00 | $4,000.00 | $4,000.00 | $4,000.00 | $4,000.00 | $4,000.00 | $231,854.81 |

Total IRR = 6%

Not so hot. You can see how even with my impressive 10% cash on cash return, with the disappointing IRR, your investment didn’t perform too great.

PRO TIP – In Excel highlight any number series and use the IRR function to the internal rate of return easily.

While real estate can provide some nice cash flow as a long term investment, there is more to the investment than just cash flow.

Bitcoin – Bitcoin is generally thought of as an asset that doesn’t generate cash flows, but there is more to the story.

When comparing Bitcoin to real estate, I liken Bitcoin to land. Prime coastal land with a perfect climate and an international airport that was just constructed!

The land part of a real estate investment doesn’t generate any cash flow, neither does Bitcoin if you simply hold it.

As bitcoin appreciates compared to other assets your return on investment also increases. The greater the network of Bitcoin users expands, the higher demand and higher prices for this numerically scarce asset.

However,there are ways of generating passive cash flow with Bitcoin.

The website allows users to earn compounding interest on their bitcoin investment.

Blockfi allows users to earn interest of up to 8.2% annually by holding their crypto in these interest-earning accounts.

How do they do this?

Blockfi lends crypto assets to institutional and corporate borrowers. They claim to have risk management systems in place to manage downside should a loan default and a client wishes to withdraw their funds.

The money lent to Blockfi is not super liquid as they state the withdrawal period can take up to a week.

Blockfi is an innovative and pioneering company in the world of cryptocurrency. Although the returns on Bitcoin should be enough to satisfy the average investor, earning some additional interest while you HODL never hurts!

Down the road, as Bitcoin develops more stability over time, companies like this will provide long term investors a second layer of ways to greatly profit from holding Bitcoin. I believe this is the future of finance and lending.

Bitcoin Vs Real Estate Cash flow Advantage – Real Estate (although Bitcoin may win in time)

Time and Effort – Bitcoin vs Real Estate

Real Estate – Although real estate is often classified as a passive investment it can be anything but passive.

Finding the right real estate deals, negotiating offers, managing tenants, and dealing with repairs can consume a lot of time.

I’ve worked with real estate investors that will literally look at hundreds of real estate deals per month.

I have another investor friend that got hit with a rainy winter for his desert properties and had to repair 3 roofs in the same year. This kind of expense can ruin your profits for multiple years.

As your real estate empire grows, it can quickly develop into a full time job or a full time headache.

Real estate also offers a sense of satisfaction. I remember the sheer happiness my renters displayed when I told them I had selected them for the property.

Knowing you are providing a useful shelter for someone in need is a good feeling, especially if you are collecting a fee for your service.

To avoid many of the difficulties of being a direct property owner. Many innovative investors have looked to REITS and crowdfunding real estate deals in recent years.

These investments are beyond the scope of this article but provide some interesting alternatives to give real estate exposure without many of the management issues.

Bitcoin – Buying and holding Bitcoin is fairly straight forward at first glance. However, HODLing is not as easy as it may seem at first glance.

The first task of the Bitcoin investor is deciding on how they will custody their Bitcoin. While one could easily sign up for a Gemini account and rely on their custodial online wallet solution, many getting into the space want to hold their own private keys.

Bitcoiners may choose from a spectrum of security options ranging from self cold storage to mobile wallets to institutional investor grade custody. The wise investor will pick the option that best fits their goals, account size, and security needs.

The other fair warning I offer Bitcoin investors is falling down the Bitcoin Rabbit Hole.

Nearly all Bitcoin investors I’ve encountered end up with a growing desire to understand more about this revolutionary tech.

The Bitcoin rabbit hole may begin with an investor looking to get in for the gains, but nearly always leads to an obsession.

Learning about Bitcoin has led me to begin researching macroeconomics, the basics of cryptography, monetary history, central bank policy, and game theory.

If you take the Bitcoin rabbit hole into consideration, the effort behind being a “bitcoiner” can be considerable

Bitcoin vs Real Estate Time and Effort Advantage – Bitcoin

Summary – Bitcoin vs Real Estate Investment

There is no clear winner between the epic asset match up of Bitcoin vs real estate as an investment.

I believe both asset classes play a critical role in the modern portfolio and serve various needs of the investor.

For example a high income doctor or lawyer might find the tax benefits of real estate particularly helpful for their long term wealth accumulation. Meanwhile a savvy school teacher might decide the asymmetric nature of Bitcoin returns fit into their investment strategy easier than buying multiple rental properties.

The combination of the two assets creates a powerful freedom producing portfolio that takes advantages of the best of both worlds.

Thank you for reading this ultimate guide to Bitcoin vs real estate investing. Please let me know in the comments below which investment you prefer!

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

*https://www.irs.gov/pub/irs-drop/n-14-21.pdf

*https://www.klasing-associates.com/possible-1031-exchange-bitcoin-ethereum-electroniccrypto-currencies

*https://www.bitira.com/bill-could-make-crypto-transactions-tax-exempt/

*https://cointelegraph.com/news/at-8-990-000-gains-bitcoin-dwarfs-all-other-investments-this-decade

*https://medium.com/interdax/bitcoins-first-decade-2010-2020-in-7-charts-bd56e38edc15