I considered myself a fairly typical investor. I had some stocks, bonds, and a 401K. While I felt ahead of the game for trying, I wasn’t exactly Gordon Gecko.

Then Bitcoin came along.

While I admit there was some luck to stumbling upon Bitcoin in 2015, It was also a move that enabled me to take advantage of a generational investment opportunity. Let me explain why, and how this is more true today than ever.

I believe we are in the very early stages of Bitcoin becoming an established asset class for the investment world.

In the past 10 years, In the past, Bitcoin has generally been seen as a cool cryptographic experiment for techies, a fringe currency for libertarians and criminals, and an interesting opportunity for a few venture capitalists. Since its creation in 2009, Bitcoin has been through a series of bubbles each one attracting more and more people into it’s sphere of influence.

Only recently has Bitcoin begun to capture the attention of the financial world. Take a look at the following timeline –

- 2013 -Barry Silbert establishes Grayscale Investments. Grayscale has been the largest buyer on Bitcoin in 2020.

- 2013 – Famed entrepreneurs Tyler and Cameron Winklevoss buy millions in Bitcoin.

- 2014 – The Winklevoss twins establish Gemini Cryptocurrency Exchange

- 2014 – Tim Draper & Associates – Billionaire Venture Capitalist buys nearly 30,000 Bitcoin and begins investing in numerous companies in the space including Coinbase exchange.

- 2015-16 Galaxy Investment Partners – Invests heavily in Bitcoin and other Cryptocurrencies launched by Wall Street Billionaire Mike Novogratz

- 2018 – Fidelity Digital Assets – Created October 2018 focused on large institutional investors

- 2018 – TD Ameritrade invests in crypto exchange ErisX

- 2018 – Yahoo Finance adds Bitcoin and other cryptocurrencies

- 2019 – Facebook announces the launch of Libra stablecoin

- 2019 – Harvard and Yale University investment funds begin investing in Bitcoin and blockchain

- 2019 – Etrade begins offering Bitcoin futures trading

- 2020 – Paul Tudor Jones, legendary investor adds Bitcoin to portfolio

- 2020 – Chase Bank reportedly in talks with Coinbase and Gemini exchanges to provide clients with access to Digital Assets

- 2020 – Andreessen Horowitz, serial tech entrepreneur and venture capitalist, invests $515 million in a new Cryptocurrency fund. Back in 2014 Andreesen invested heavily in the crypto space in companies like Coinbase, Maker Dao, and Celo.

I could continue with the list, but you can clearly see from the events above how Bitcoin has moved from the obscure and is quickly ramping up into the mainstream.

Bitcoin, when Asset Class?

What is stopping Bitcoin from instantly becoming a major asset class like Gold, Real Estate, or Equities?

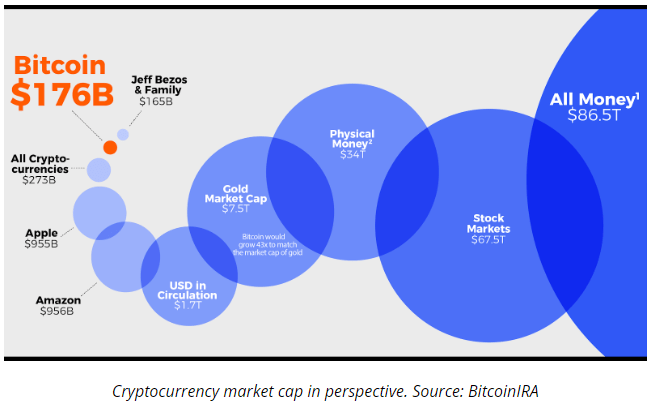

The entire market cap of Bitcoin is extraordinarily small.

At the time of writing, all of the Bitcoin in the world is valued at $179 billion. Compare this to the entire market cap of gold at around $9 trillion US.

The total value of all real estate in the US is valued at around $33 trillion and the world’s real estate at over $217 trillion.

How much Bitcoin is available on the open market?

Currently, there is an estimated circulating supply of 18 million bitcoins from a total of 21 million to be eventually mined. Estimates say 4 million bitcoin have been lost by individuals misplacing their keys or destroying an old computer.

That leaves us with 14 million bitcoins available.

In 2020, it was estimated that over 60% of Bitcoin has not moved in over a year and 40% has not moved in over 2 years (source: https://unchained-capital.com/blog/hodl-waves-1/).

The chart below illustrates the behavior of Bitcoin investors holding (HODLing – Holding on for Dear Life) on to their coins for longer and longer periods of time. As you can see more buyers are considering Bitcoin something they want to preserve their wealth in as time grows.

Let’s say 60% of the 14 million coins are not available for purchase at current prices. That leaves us with around 5.6 million bitcoins that are fairly liquid. Now let’s consider some investment giants.

Institutional Investment

- BlackRock over $7.4 trillion assets under management

- Vanguard Group $6.2 trillion

- UBS $3.2 trillion

- State Street Global Advisors $3.12 trillion

- Fidelity Advisors 3.2 trillion

These behemoths of the financial world operate on a scale far greater than the current state of Bitcoin.

Buying bitcoin for an institutional investor presents several problems. The world’s 20 largest asset managers combined oversee $42.3 trillion.

A mere 0.5% investment in cryptocurrencies would exceed $211 billion — equivalent to 84% of the total market cap.

At current prices, Bitcoin is simply not big enough to be playing on the main stage.

Logistically buying bitcoin presents hurdles for these massive companies. How can a huge financial organization safely store, and manage billions in bitcoin holdings?

I don’t think Jamie Diamond, CEO of chase bank, is going to be storing his crypto on his Trezor thumb drive like the rest of us.

Lastly, massive institutions also face tremendous regulatory scrutiny for the services they provide. The legality of offering Bitcoin and other innovative digital products to their clients comes into areas of the law that are just now being sorted out.

Scaling Bitcoin and Personal Finance

Part of the genius in the design of Bitcoin is that in order to scale it needs to prove itself with greater and greater communities of users.

The price of Bitcoin is an extrapolation of how many people find it useful. I believe we are now in the era of Bitcoin as a personal finance tool for investment, capital preservation, liberation, and innovation.

We are seeing a progression in Bitcoin users from the bottom up. The trend started with Individuals, then futurists, venture capital, start=up companies, and is now on knocking on the door to the financial world.

Bitcoin has scaled in a similar way in the world of Bitcoin mining from individuals to massive global mining pools and multi-million dollar facilities. The scaling has happened quickly and is progressively getting larger and larger.

As Bitcoin continues to scale up, the offering to the financial world is becoming ever more attractive.

Solutions such as institutional custody have arrived. The regulatory environment has been continually improved upon and lawmakers are providing clear guidelines for holding digital assets.

We are currently seeing high net worth individuals, family financial offices, innovative investment funds, endowment funds, and smaller financial institutions interested in Bitcoin.

This is where I believe Bitcoin can play a role in personal finance.

This unique market opportunity presents an asymmetrical opportunity for returns. While every investment involves risk, not every investment holds the potential upside that Bitcoin does.

The purpose of this blog is to share my thoughts, strategies, and ideas on how Bitcoin can be used as a tool to gain financial freedom. We’ll be looking at Bitcoin through the lens of personal finance on the scale of an individual investor. Thank you for reading. We are The Bitcoin Investors!

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research

source cointelegraph.com/news/5-reasons-why-institutional-investors-refuse-to-join-the-crypto-sector

source thebalance.com/which-firms-have-the-most-assets-under-management-4173923