This blog is dedicated to Bitcoin investing in the world of personal finance. I believe Bitcoin is not only good for the world, but an amazing tool for the individual investor to achieve their financial goals. In this article, we’ll be addressing the 4 money moves every Bitcoin and cryptocurrency Investor should make!

1. Acquire 1 whole Bitcoin (minimum)

Imagine it is your first time buying Bitcoin. You log onto Coinbase and see the exchange rate for Bitcoin is $11,700 (at the time of writing)!

“Darn, that is too expensive,” you say to yourself. I can buy a ton of these XRP coins, they are only .28 cents!!!

Don’t do it! The first order of business for any Bitcoin investor is to own 1 whole Bitcoin (minimum). Even if you have to slowly stack those Satoshis in order to get to the 1 Bitcoin minimum.

The power of Bitcoin’s exponential growth lies in it’s fixed supply.

There will never be more than 21,000,000 Bitcoin in circulation.

To give that number some context, there are currently 46.8 Millionaires in the world.* There is not enough Bitcoin in the world for every millionaire to hold half of a Bitcoin (.5 BTC).

Please note that I not completely against other cryptocurrencies (I’m 90% against them as investments). In fact, I have made a ton of money on Ethereum, the number 2 cryptocurrency in the world, when I bought at $11. If you can find opportunities and ways to make money on Altcoins, more power to you!

However, other cryptocurrencies are not of the same kind, quality, and strength as Bitcoin. Look for my future article on why Bitcoin vs Altcoins.

Other cryptocurrencies may not have a fixed supply like Bitcoin.

In addition, many cryptocurrencies have a supply of trillions of coins making their price appear low. The above mentioned XRP has a circulating supply of 44,942,589,751.*

Since each Bitcoin can be divided into 100,000,000 units you do not have to purchase a whole Bitcoin. If you priced Bitcoin in Satoshis, the price would seem very reasonable per unit. It is pure psychology.

Therefore the question should be asked, does it matter that you hold one whole Bitcoin?

Yes, and no. In theory, it doesn’t matter and you should hold as much as you are comfortable with and fits your financial goals and constraints.

However, as a benchmark owning one whole Bitcoin is a very powerful goal.

With the goal of owning a Bitcoin you will not be distracted by the constant noise you will find in the altcoin market. The altcoin market is wrought with scams and get-rich schemes. History has so far proven Bitcoin to be one of the few thousands of cryptocurrencies with ultimate staying power.

If you are like me, owning Bitcoin will help you begin to develop an interest and an education in this revolutionary technology.

I believe there will soon become a time when owning one whole Bitcoin will be a status symbol that is out of reach for the greater majority of investors. Wouldn’t you like to be in those ranks?

Do yourself a favor and obtain a minimum of one whole Bitcoin.

2. Think about Retirement with Bitcoin IRAs

The Bitcoin price has been a roller coaster of volatility going through 4 major price bubbles. This naturally leads investors to think about the short term time horizon.

If Bitcoin continues on its current trajectory imagine what the price will be like in 30-40 years.

If you are a younger person with many years to go until retirement, why not add a volatile asset like Bitcoin to your retirement portfolio?

Sure, there is a risk factor in adding Bitcoin to your retirement money. The experiment could fail and your investment will be gone.

Retirement planning experts typically steer clients toward large mutual funds and ETFs that automatically diversify a portfolio by investing in numerous companies and spreading your dollars across various sectors and markets.

Opening an IRA with allocations to Bitcoin doesn’t mean that you have to go 100% in Bitcoin. Bitcoin can serve as an asymmetric tool to boost your returns if the asset class continues to make significant gains.

There are several different types of IRAs and retirement accounts investors can choose from. If you qualify, a Bitcoin Roth IRA enables the investor to enjoy 100% tax-free gains at the time of retirement. I’ve written a full article all about the retirement account investments you can easily make in Bitcoin.

A word of warning, according to the IRS, investments in a retirement account require a qualified custodian. Since Bitcoin is only 11 years old and a departure from the traditional financial world this makes it slightly more complex to achieve exposure to Bitcoin with a retirement account.

In recent years we have seen custodial companies like BitIRA pop up allow you to invest directly in Bitcoin with retirement accounts.

These custodial companies will hold your Bitcoin, insure it, and keep it secure without the hassle of learning how to store your own Bitcoin. If this interests you, please use the link above or the banner ad for more information.

3. Hodl for at least 1-4 years

Supply and Demand are the most basic and powerful economic forces.

The demand for Bitcoin has been steadily growing over time. Given demand and growth either remaining the same or increasing, the variable investors look at is supply.

The supply of Bitcoin is completely known and built into the protocol.

New Bitcoin is steadily minted over the course of time as miners verify transactions on the blockchain. Bitcoin miners are rewarded with this Bitcoin for their valuable services securing the transaction history.

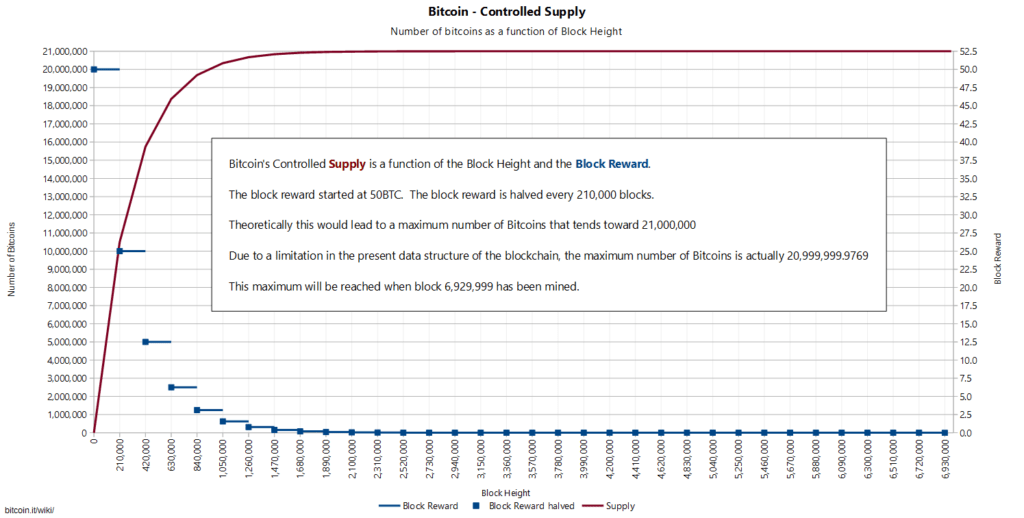

In the beginning, 2009, miners were rewarded with an impressive 50 Bitcoin per block mined.

Every 210,000 blocks mined, which roughly equals 4 years, the Bitcoin supply is cut in half!

In 2012, the Bitcoin supply was cut to 25 bitcoins rewarded to miners. In 2016, the supply was reduced to 12.5 BTC.

Our last halving in May of 2020 cut the Bitcoin supply to 6.25 BTC per block reward.

The supply will continue to be cut every 210,000 blocks or roughly every 4 years until the Bitcoin protocol has reached a total number of nearly 21,000,000 Bitcoin in circulation. See the chart below for a graphical representation.

As the supply of Bitcoin declines the scarcity increases dramatically. It is this digital scarcity that has driven demand and subsequently the Bitcoin price.

Historically, as these supply shocks are built into the protocol we have seen price bubbles subsequently form in response to the increased demand.

For this reason, Bitcoin investors must Hodl their Bitcoin for a minimum of 1-4 years.

Even better strive to Hodl your Bitcoin for longer. I believe the case can be made as a personal investment strategy that Bitcoin will continue long into the future to play a pivotal role as a personal tool for saving and investing.

You can make the argument that Bitcoin will be in high demand until it transitions into a more stable store of value reaching its peak use-case as a unit of account. I discuss some of these endgame scenarios in this article.

As an investor, you may also choose to transfer some of those presumed gains into other less volatile assets or even trade your Bitcoin for incredible experiences. All of these are viable strategies.

There is another incentive to hold your Bitcoin for a minimum of 1 year.

Bitcoin is currently taxed upon exchanging or spending as if they were personal property (in the United States). This means that Bitcoin is subject to capital gains tax for any positive price appreciation that may occur between the time that you purchased and sold (or traded) your Bitcoin.

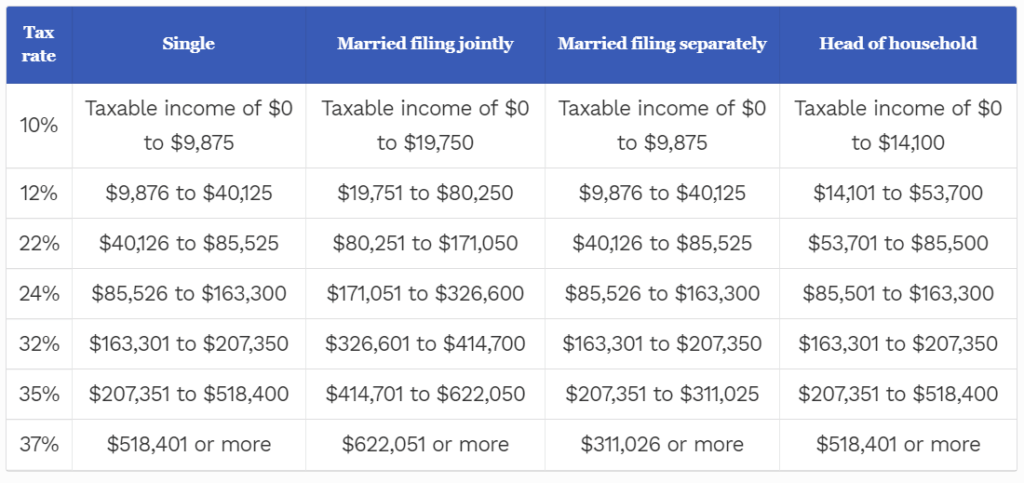

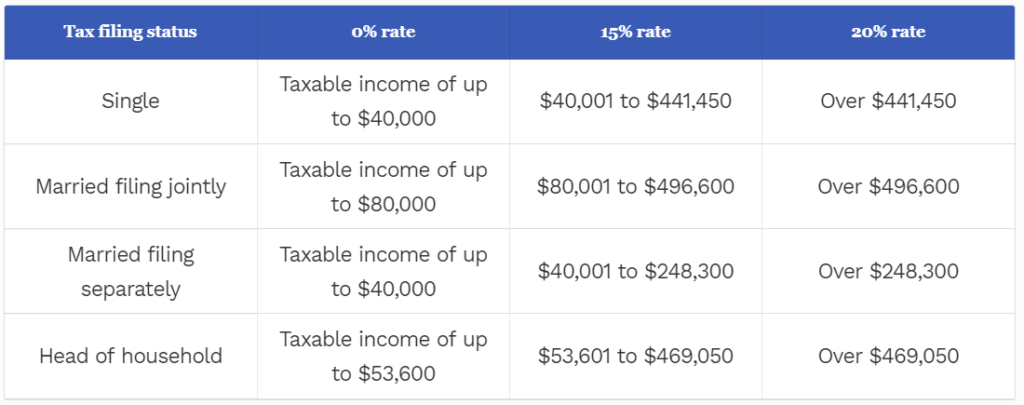

The US divides up capital gains tax into short term and long term. Short term capital gains are defined as assets held for under 1 year and long term is over the 1-year mark.

Short term capital gains tax incurs a far greater tax burden than holding your assets for longer. Short term capital gains are taxed on top of your income. See the tables below.

For a top earner, this could mean the difference of 17% tax or a total of 37% of your gains will be owed to the Federal Government upon selling Bitcoin.

If you ever plan on selling your Bitcoin or trading it for another asset, know that holding it for a minimum of a year can save you a lot of money.

4. Move your Bitcoin (Private Keys) Off the Exchange

One of the revolutionary ideas behind Bitcoin is that it allows the individual to obtain complete sovereignty over their money.

Recent history has been filled with central banks bailing out massive corporations, Governments printing money until their citizen cannot buy a loaf of bread without a wheelbarrow of cash, and citizens unable to withdraw their funds from the bank.

With Bitcoin your money cannot be taken from you by a third party. No longer do individuals need to trust in institutions like central banks and governments.

With that said, it may come as a surprise, but Bitcoin owners do not really store their own Bitcoin. Instead, they store a set of private keys.

Private keys are part of the magic that secures Bitcoin transactions. Hence, the famous Bitcoin slogan –

Not your keys, not your Bitcoins!

Popularized by Andreas Antonopoulos

Understanding the basics of moving your cryptocurrency and Bitcoin off of an exchange is a critical move that every investor should understand and be able to complete.

Most people’s first interaction with Bitcoin is typically through an online Bitcoin exchange. These exchanges will typically hold your funds on the platform for you as long as you like.

However, history has proven that this is not always a reliable place to keep your funds safe. You are always one exchange hack or company exit-scam away from financial disaster.

It is critical that every Bitcoin investor understands, educates, and take the necessary effort to secure their digital assets.

11 Years after the creation of Bitcoin, the market already has a massive variety of methods to store Bitcoin.

From cold storage wallets to hot storage mobile wallet apps, the options are staggering. In a later article, we will get into some specifics and recommendations for storing your cryptocurrency.

In the meantime, check out Bitcoin expert, Jameson Lopp’s recommendations for wallets and their pros and cons.

That completes our list of the 4 Money Moves that Every Bitcoiner should make. That you for reading, Happy Investing!

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

*https://abcnews.go.com/Business/half-worlds-entire-wealth-hands-millionaires/story