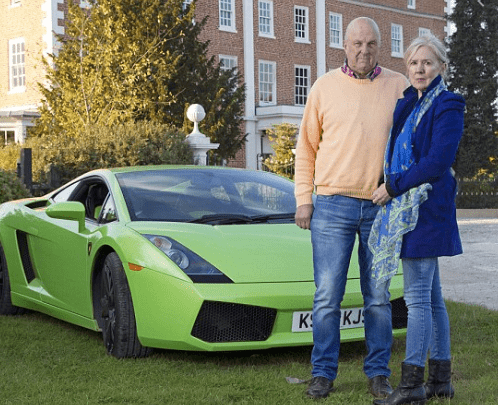

In the year 2020, we are now entering the dawn of smart money talking about Bitcoin investing. Up until this point it has been very hard to avoid talk of out of control speculators, Lambos, day trading, and get rich quick schemes.

In the world of personal finance, the discussion pivots toward long term yield, diversification, and early retirement plans.

It is my belief that as Bitcoin becomes more mainstream the two conversations are going to converge into one. As this asset class matures, adds liquidity, and rewards a new era of risk-takers, Bitcoin will become an essential ingredient of a well-balanced portfolio.

The following discusses using Bitcoin as a tool to add to your long term retirement strategy.

Why add Bitcoin to a 401K or IRA?

The advantage of adding Bitcoin to your 401K lies in converting some of your hard-earned cash into a tax-free investment.

Tax-advantaged accounts give the investor an incentive to save for the future. The Bitcoin investor should naturally gravitate toward these accounts as holding Bitcoin is appealing to those wishing to save and maximize their returns.

Bitcoiners believe that the exchange value of the Bitcoin they hold will generally go up over time, or at very least will retain value compared to other assets. Naturally, one would like to keep much of these returns for themselves rather than handing a check over to the government.

Bitcoin is currently taxed as a capital gains tax in the US. If you hold Bitcoin for less than a year you will be taxed at the short term capital gains tax rate (between 10 and 37% depending on your income). If you hold Bitcoin for longer than a year you will be taxed at the long term capital gains tax rate (between 0-20% depending on your income).

By holding on to your Bitcoin for longer than a year you automatically save between 10-20% depending on your tax bracket.

With a retirement account, one can strategically enjoy tax-free or deferred growth of their assets over the long term. If you believe Bitcoin to be an asymmetric wealth-building opportunity in the long term, a tax advantage account can make the opportunity even more lucrative!

The problem with adding Bitcoin to your retirement account is that it is not that simple.

Buying Bitcoin with 401K

This may be an option for you and it may not. In order to invest in Bitcoin with your 401K you will need a Self-Directed 401K.

A self-directed 401K allows you greater flexibility with your company’s 401K plan to invest the funds in any way you see fit. The con here is that not all companies allow for a self-directed 401k.

You can try to call your 401K administrator and see if you can convert your 401K to be self-directed. If a self-directed 401K is an option, you can choose to invest in Bitcoin, real estate, or whatever else is deemed legal investment and allowed under the rules of the 401K administrator.

Most employer plans have limited options for investing, and I have yet to come across one that includes Bitcoin as an option. My current plan allows me to invest in a grand selection of about 30 stocks and bond-based ETFs. 401K managers are required by law to invest funds in a regulated manner with certain fiduciary responsibilities to the investor. Although lawmakers are making progress in this area, the new field of Bitcoin and cryptocurrencies is not quite ready to make its way into your employer’s 401K plan. I am confident that in time ETFs that feature a portion of the overall fund dedicated strickly to Bitcoin or Bitcoin and maybe some of the top Altcoins.

Buying Bitcoin with a Self-Directed IRA Brokerage Account

If your 401K is not flexible then your next option is to invest in Bitcoin yourself through a self-directed IRA.

IRA’s can be opened through any major brokerage account such as e-trade, Ameritrade, Charles Schwab, etc. Like a self-directed 401K, your options here are whatever these brokers provide. The good news is the offering from these brokers tends to be a lot more diverse and face far fewer restrictions than 401K’s offer.

Many of these brokers offer GBTC, the Grayscale Bitcoin Trust. Grayscale owns the unique honor of being the world’s first publicly quoted security that derives its value from Bitcoin. Grayscale owns a tremendous amount of Bitcoin and has them securely stored with XAPO custody. It may sound like a James Bond movie, XAPO offers cold storage of crypto assets in a decommissioned military bunker in the Swiss Alps.

Each share in Grayscale represents owning about .00096 of a Bitcoin, but fluctuates depending on the fees and price of Bitcoin. There is a downside to GBTC as the premium for owning Bitcoin can fluctuate wildly. In some cases, the premium has been as high as 1.5X the price if you were to buy Bitcoin directly through an exchange.

If you fancy yourself a trader, you can even open a Bitcoin futures trading account with an IRA or Self-Directed 401K on many brokerage platforms. The Chicago Mercantile Exchange (CME) offers Bitcoin futures trading that can be managed through an IRA account for tax advantages.

These futures contracts settle on the price of Bitcoin and do not actually involve owning actual Bitcoin. Additionally, these contracts expire on various monthly intervals so you can’t just you’d have to be an active trader to take advantage.

I’d personally be very wary of actively trading in a retirement account unless you are an experienced professional. Read my article on technical analysis and bitcoin trading here.

IRA vs Roth IRA for Bitcoin

When it comes to Bitcoin the Roth IRA takes on a tremendous advantage to a traditional IRA if you qualify. In order to qualify to invest with a Roth IRA you need to have taxable income less than 139K per year as an individual and 206K per year for a couple (2020).

The beautiful thing about a Roth IRA is that investment gains are not taxable upon distribution in retirement.

Therefore if you are a Bitcoin bull and expect the value of Bitcoin to be much higher in the future, you will not have to pay Uncle Sam for any Bitcoin appreciation.

With a traditional IRA, you will, unfortunately, have to pay taxes on the gains you experience as long term capital gains upon the time of distribution.

In other words, if you make a significant amount of money the traditional IRA will help you with tax savings in the present, but your potential future Bitcoin gains will be taxed with a long term capital gains tax (currently at 20% for highest income groups).

IRA Bitcoin Custodian Account

The IRS requires all IRA accounts to have a custodian or a trustee approved by the IRS.

In order to own Bitcoin more directly than something like the Grayscale Bitcoin Trust, which derives its value from Bitcoin, investors with an approved custodian allows for more direct ownership of their coins.

There is a growing number of companies that offer Bitcoin Custody through a self-directed IRA account. These companies charge a setup fee and ongoing fees for their services. Many of these services also offer investors the ability to invest in other cryptocurrencies such as Ethereum, Litecoin, and Ripple (XRP).

One of the more popular choices for Bitcoin IRAs is BitIRA.com.

Like a bank, this custodian will hold actual Bitcoin for you rather than the value derived from the spot price of Bitcoin. BitIRA will serve to perform the administrative and Bitcoin storage duties for you so you can legally store Bitcoin in a retirement account.

These custodial services also offer insurance and customer support. IRA Custodians can be a great option for someone wanting Bitcoin exposure without the concerns of privately storing your own private keys to your Bitcoin.

Summary of Bitcoin Retirement Options

| Retirement Account Type | Difficulty to Setup | Capital Required | Ownership | Investment Flexibility |

| Self-Directed 401K | High | Low | Low | Low |

| Self-Directed IRA | Low | Low | Low | Low |

| Bitcoin IRA Custodian | Low | Medium-High | High | High |

If you are a long term Bitcoin bull, retirement account options present a great opportunity to maximize your return with tax-advantaged accounts.

As the technology matures, I am confident we are going to see a significant increase in investment opportunities in this space.

It is counter-intuitive as Bitcoin is a distributor to wall street and the traditional financial model. However, as we manage our money at this time in history we begin to see some combination of the old world and the new. It will be interesting to see how it all develops but in the meantime happy investing!

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research