Bitcoin during a War vs Tradfi

Bitcoin, the enigmatic digital asset, occupies a unique space within the financial landscape. Proponents hail it as a revolutionary technology and a store of value untethered from traditional financial systems. However, its price movements often mimic high-growth tech stocks, raising questions about its behavior during periods of economic turmoil, particularly war. This article dissects the potential performance of Bitcoin in a wartime scenario, acknowledging its dual nature – as a risk asset and a potential inflation hedge.

Risk On, Risk Off: Understanding Asset Class Behavior

Understanding the concept of risk assets and risk-off assets is crucial when analyzing Bitcoin’s potential wartime performance. Risk-on assets, which include equities, high-yield bonds, and certain commodities, tend to thrive in periods of economic optimism and growth. Investors are more willing to embrace risk in anticipation of higher returns. Conversely, risk-off assets, such as government bonds, gold, and the Japanese Yen, experience increased demand during times of uncertainty and economic contraction. Investors seek the perceived safety of these assets, prioritizing capital preservation over high returns.

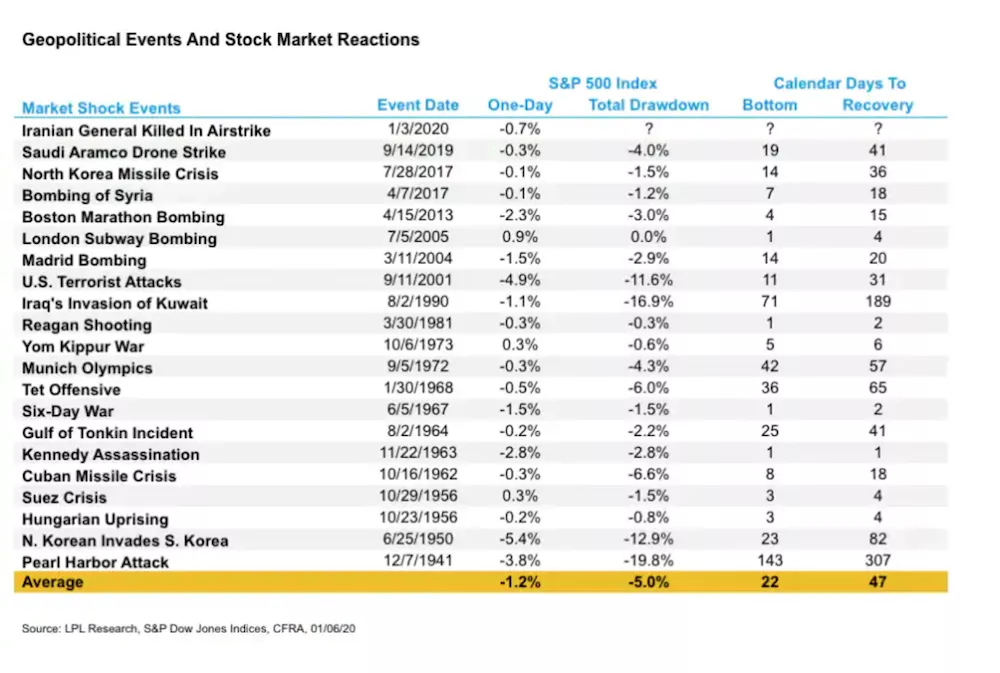

Historically, traditional financial markets exhibit a clear pattern during wars. The initial outbreak of war often triggers a risk-off flight to safety. Investors pull back from riskier assets like equities, fearing a decline in corporate profitability and economic growth. This can lead to a decrease in the prices of risk-on assets. Conversely, risk-off assets, such as government bonds, typically experience price appreciation as investors seek shelter.

Bitcoin: The Tech Stock Charade and the Wartime Vulnerability

Bitcoin’s early years were marked by a strong correlation with high-growth tech stocks. Its price movements often mirrored broader market trends in the technology sector. This correlation can be attributed to several factors. Firstly, Bitcoin’s underlying technology, blockchain, is viewed by many as a revolutionary innovation with the potential to disrupt numerous industries. This association with cutting-edge technology positions Bitcoin as a growth asset in the eyes of some investors. Secondly, a significant portion of Bitcoin trading activity occurs on cryptocurrency exchanges, which often exhibit speculative trading behavior similar to stock exchanges.

This tech-stock-like behavior raises concerns about Bitcoin’s resilience during wartime. If a war triggers a risk-off environment, Bitcoin’s price could suffer alongside other growth assets. Investors might be hesitant to hold onto a volatile asset class when economic uncertainty reigns supreme. The initial response to a war could, therefore, be negative for Bitcoin.

The Store of Value Narrative: Can Bitcoin Shine When Fiat Currencies Falter?

However, Bitcoin’s narrative as a store of value presents a counterpoint to its vulnerability as a risk asset. Proponents argue that Bitcoin, with its finite supply capped at 21 million coins, offers a hedge against inflation. Unlike traditional fiat currencies, which central banks can manipulate through quantitative easing, Bitcoin’s supply is predetermined and cannot be arbitrarily inflated. This characteristic is particularly attractive during wartime, when governments might resort to printing money to finance war efforts, potentially leading to devaluation of fiat currencies.

Furthermore, Bitcoin’s global accessibility and borderless nature could prove advantageous in a wartime scenario. Traditional financial systems can be disrupted by war, with governments potentially imposing capital controls or freezing assets. Bitcoin, on the other hand, operates on a decentralized network, making it resistant to such restrictions. Individuals seeking to preserve their wealth in a war-torn region could find Bitcoin’s portability and censorship resistance appealing.

History offers some anecdotal evidence to support Bitcoin’s potential as a wartime store of value. While the asset class is still young, its price did exhibit some resilience during the initial stages of the Russia-Ukraine conflict in early 2023. While there was an initial dip alongside broader market weakness, Bitcoin’s price recovered relatively quickly, suggesting that some investors viewed it as a potential hedge against the economic uncertainty caused by the war. (read about why I don’t believe you should sell your Bitcoin here)

The Long View: Untangling the Complexities of Bitcoin’s Wartime Performance

Predicting Bitcoin’s performance in a large-scale war remains a complex task. The asset class is still evolving, and its historical track record is relatively short. However, by acknowledging its dual nature – as a risk asset and a potential store of value – we can arrive at a more nuanced understanding of its potential wartime behavior.

In the initial stages of a war, Bitcoin’s price could be susceptible to a risk-off sell-off alongside other growth assets. However, in the long run, its finite supply and resistance to central bank manipulation could position it as a valuable store of value, particularly if traditional fiat currencies experience devaluation. Investors seeking exposure to Bitcoin during wartime should be prepared for short-term volatility but may find solace in its potential long-term resilience.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

Leave a Reply