I am laying out the 3 main reasons to be bullish on Bitcoin for the rest of year and beyond.

The price of Bitcoin has been on the pumping lately and investors are excited. At the current time of writing, the price recently breached $11,000.

1. Lack of other Asset Alternatives

Covid-19 has affected the global economy greater than any event in recent history. It leaves the average investor scratching their head as to how to invest during this pandemic.

The actions of governments and central banks have made asset prices hard to value. On the one hand, you have massive amounts of money printing. On the other hand, you have businesses suffering and horrific unemployment numbers.

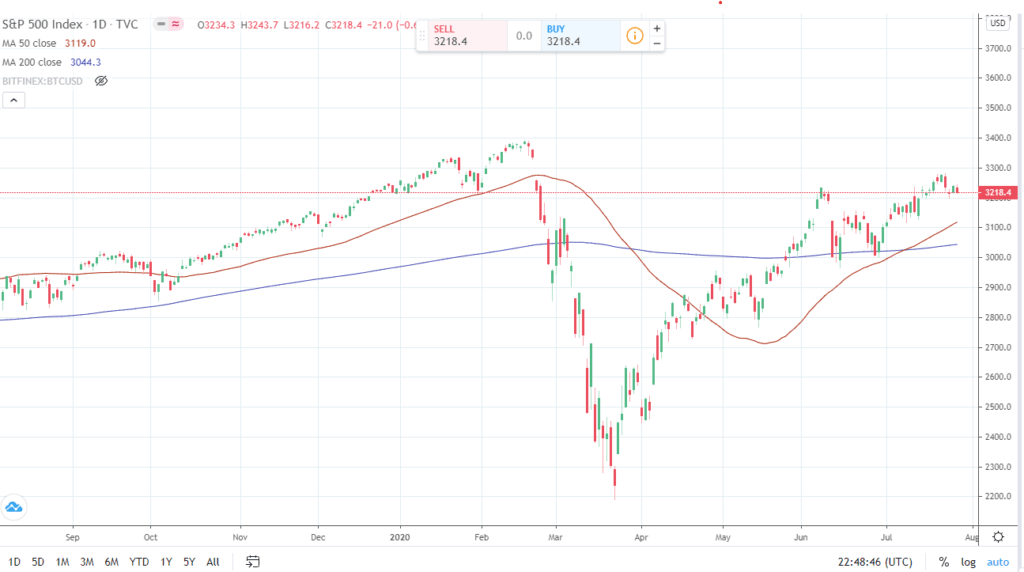

After a fairly steep stock market plunge at the beginning of the pandemic, the stock market has responded to the stimulus with a powerful rally.

How can the stock market be rallying while most American businesses are struggling to keep their doors open?

The answer to this question lies in the actions of the Federal Reserve. As they have continued to pump liquidity into the system, holding assets becomes ever more attractive than holding US dollars.

It becomes very clear to see that the last few months’ market rally isn’t based on business fundamentals, but rather the actions of the Fed. What happens when the flow of free money stops?

Does anyone really think US companies are doing better as a whole?

This is what makes Bitcoin so bullish right now.

Bitcoin was created for this exact situation.

There will only be 21 Million Bitcoin making the currency deflationary. As more and more people wake to the reality that their US dollars they worked extremely hard and saved up are quickly becoming worthless, they will want to acquire and use more Bitcoin.

How about Real Estate? The government have enabled laws that impose on the free market and prevented landlords from demanding payment from tenants.

Low-interest rates have started to drive up property prices in some areas and increased affordability. However, with tremendous unemployment numbers, I can’t see real estate having a tremendous upside in the coming months.

What about gold? Let me be clear in saying, I am not in the anti-gold camp and actually have a decent amount of my portfolio in gold and gold miners.

Gold has served as a hedge to currency inflation and stock market crashes for centuries. I believe gold will bode well over the next few years until investors are able to see better returns investing in businesses.

However, gold doesn’t do half of what Bitcoin can do (see my future article on Bitcoin vs Gold here). Bitcoin embodies the desirable characteristics of gold while being more divisible, fungible, and secure. Lastly, I can see a massive rally with gold, but I can’t see the price going up 10X. With Bitcoin anything is possible.

To quote Billionaire bitcoiner Tim Draper, “Why would I want to trade new money for old money.”

2. Bitcoin Reward Halving

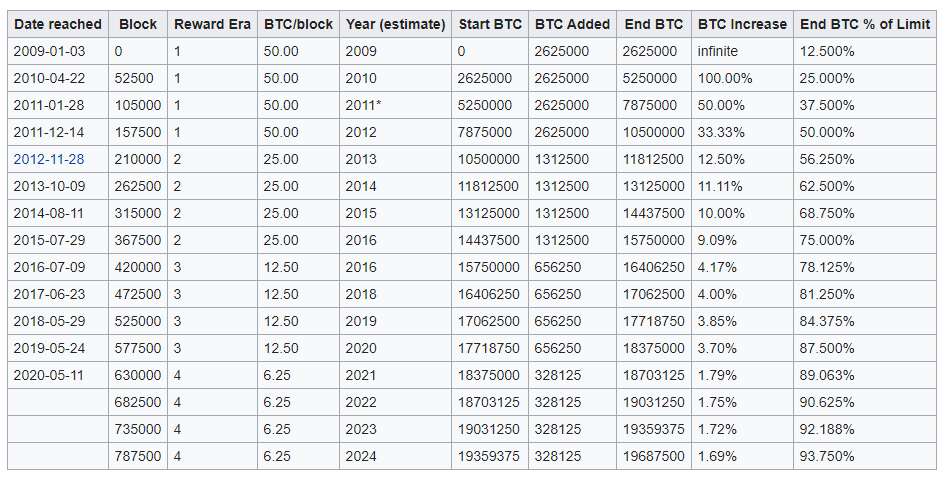

Every four years the Bitcoin protocol undergoes a block reward halving that is also known as a Bitcoin Halvening.

When a miner successfully verifies all transactions in a block and solves a mathematically difficult cryptographic puzzle they are rewarded with a subsidy for their efforts. This subsidy is paid out in Bitcoin. So far the protocol has undergone two halvings.

- January 3rd, 2009 – Creation of Bitcoin – Block Reward 50 Bitcoin

- November 28th, 2012 – First Halving – Block Reward 25 Bitcoin

- July 9th, 2016 – Second Halving – Block Reward 12.5 Bitcoin

- May 11th, 2020 – Third Halving – Block Reward 6 Bitcoin

Satoshi Nakamoto had the foresight to design a block reward that would decrease over time. This genius in the design of Bitcoin creates strong incentives for people to use and hold the currency as Bitcoin becomes more scarce over time.

As the reward for Bitcoin becomes more scares, less and less Bitcoin becomes available for the world. Bitcoin issuance :

Why does a decrease in the Bitcoin block reward equal a bullish scenario for Bitcoin?

The simple answer is found in our most basic economic law of supply and demand. As the supply of Bitcoin continually decreases, the demand for the usage of those coins increases.

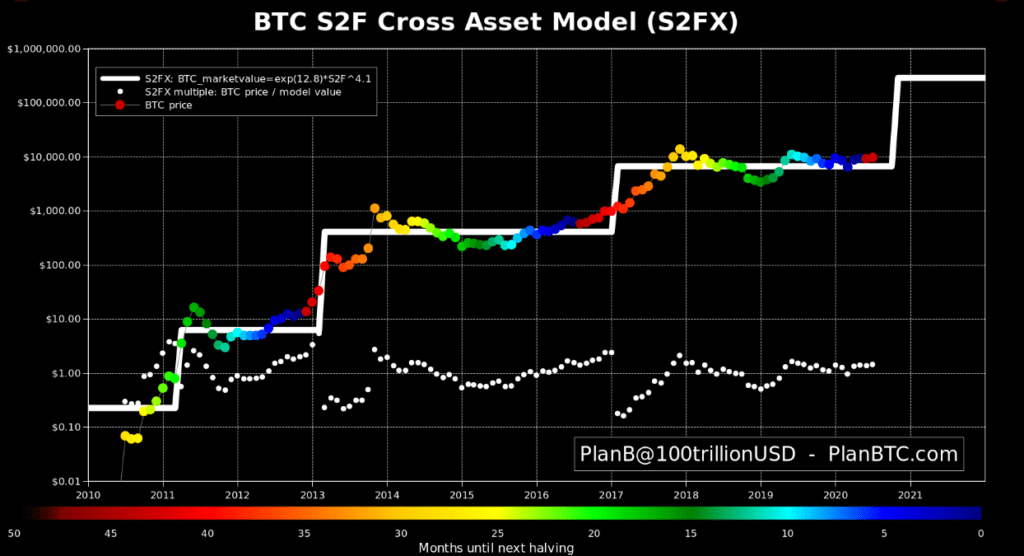

There has been some tremendous work done by Analyst Plan B, on the predictive price action of this cycle on what is called Bitcoin’s Stock to Flow Ratio.

I am a huge fan of Plan B’s work and the calculations he has done to create the price model below. Plan B is a brilliant, humble, highly educated, and professional macroeconomic analyst from the traditional finance sector.

Another aspect of this phenomenon that is rarely discussed is the motivations behind Bitcoin miners (more in-depth future article coming soon).

Bitcoin miners maintain a costly operation by running highly powered computers with huge electricity bills. The Bitcoin miners are rewarded with Bitcoin but need to pay their electricity bills in their countries home currency.

This creates a huge amount of sell pressure as these miners sell their earned Bitcoin on the open market in exchange for keeping their operation running.

When the Bitcoin block reward is cut in half, the profitability of miners goes down significantly as they are earning less Bitcoin for roughly the same effort (there is a mechanism called “difficulty” that adjusts to the demand in mining power, but this is beyond the scope of this article).

What do miners then do? Give up on all the capital they invested and throw in the towel?

Nope, they protect their capital investment by holding more Bitcoin.

The stronger miners that saved for the winter and invested in the most efficient machines stay alive and keep the price afloat. This creates less sell pressure and boosts the price of Bitcoin also adding to the scarcity of the equation.

3. Trader Psychology

In 2015 there was no shortage of Bitcoin detractors saying the Bitcoin bubble had popped. Rinse and repeat for 2018. Everyone said the Bitcoin bubble has popped and the speculation is over!

Guess what?

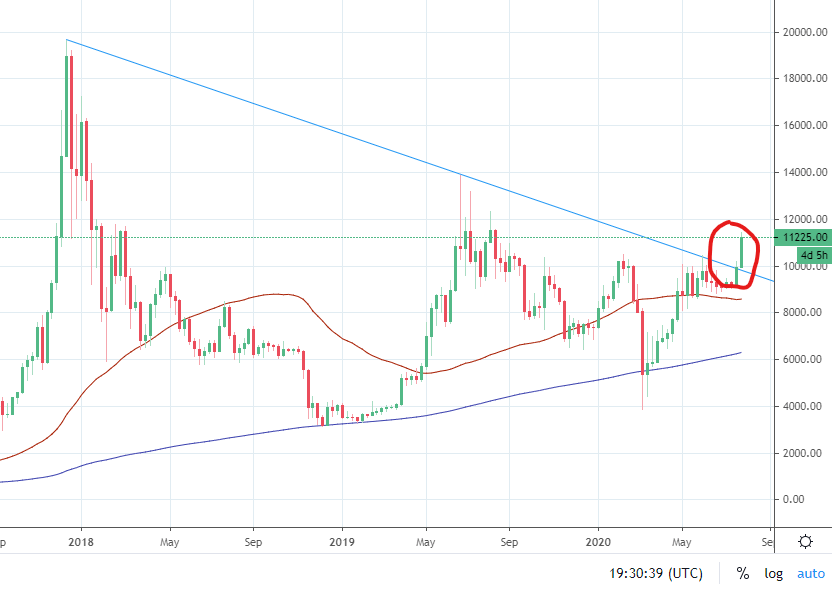

Bitcoin just broke some major technical resistance.

Take a look at the bearish trend line on the chart above.

You will see that the Bitcoin price has just now breached this line set up by the highs of the last two years. As the price action steadies out over time, the more Bitcoin proves it isn’t Beanie Babies or Tulips.

You can see some potential areas of resistance at $11,500 where the price has been rejected a couple times in the past and perhaps another around $16,000.

After that, we will see the ATH tested and blue skies beyond. So far Bitcoin is up 55% year to date, and I expect this trend to continue.

Conclusion

There are many reasons to be a Bitcoin bull right now. Does this mean that there is going to be a vertical line up to new all-time highs?

Probably not. The Bitcoin market has always been a one marked with powerful volatility and gut-wrenching swings to highs and lows. Happy Investing.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.