Alright, Bitcoin comrades, gather ’round the digital campfire. Tonight, we delve into the ever-intriguing Bitcoin halving – an event about as predictable as a rogue tweet from Elon.

But fear not, for I, your friendly neighborhood MoneyinBTC Tech investor extraordinaire and fellow Bitcoin enthusiast – am here to crack open this algorithmic chestnut and see what’s inside.

Before we get down to the nitty-gritty of halving mechanics (because let’s face it, who doesn’t love a good mathematical breakdown?), let’s establish some ground rules.

Rule number one: For those unfamiliar with the Bitcoin halving, fret not! Consider this your crash course in Satoshi’s grand plan to make Bitcoin scarcer than a winning Powerball ticket.

Rule number two: The big question on everyone’s mind – has this halving been priced into the market already? Buckle up, because we’re about to dissect that question like a seasoned Wall Street analyst picking apart a dubious earnings report.

So, grab a metaphorical glass of blockchain punch, and let’s get this halving party started!

This introduction sets the stage with humor, establishes your expertise, and clearly lays out the purpose of the article – all while incorporating the keyword phrase “Bitcoin halving” naturally.

The Mechanics of the Bitcoin Halving: Satoshi’s Clockwork Money Machine

Alright crew, time to strap on your thinking caps. We’re about to dive into the beautiful machinery behind Bitcoin’s magic trick: its programmatic monetary policy.

Imagine this: a giant, digital gumball machine programmed by a mysterious Satoshi Nakamoto. Every 10 minutes, with clockwork precision, this machine spits out a shiny new Bitcoin – 6.25 glorious coins at the time of writing (but that’s about to change, wink wink). This, my friends, is the essence of the block reward.

But here’s the twist – unlike your average gumball machine fueled by loose change, this one has a self-imposed scarcity protocol. Every 210,000 gumballs dispensed (or, ahem, blocks mined) – roughly every four years – the reward gets cut in half. That’s the Bitcoin halving in a nutshell.

Now, this halving isn’t some random act of algorithmic sadism. It’s a core tenet of Bitcoin’s design, carefully crafted by Satoshi to mimic the finite nature of, well, actual gold.

So, there you have it, folks. The Bitcoin halving: a pre-programmed event designed to keep those new Bitcoins trickling out at a predictable rate, forever etching a limit of 21 million coins into the fabric of the blockchain.

But the question remains – does the market anticipate this halving frenzy, or are we in for a surprise after all? Next, let’s dive into the market participants that are most affected by the halving: Miners.

Miners: The Reluctant Bartenders of the Bitcoin Saloon

Now, let’s mosey on over to the not-so-glamorous side of the Bitcoin game: the miners. These folks are the backbone of the network, solving complex mathematical puzzles to secure the blockchain and earn those sweet block rewards – our gumballs from the previous section.

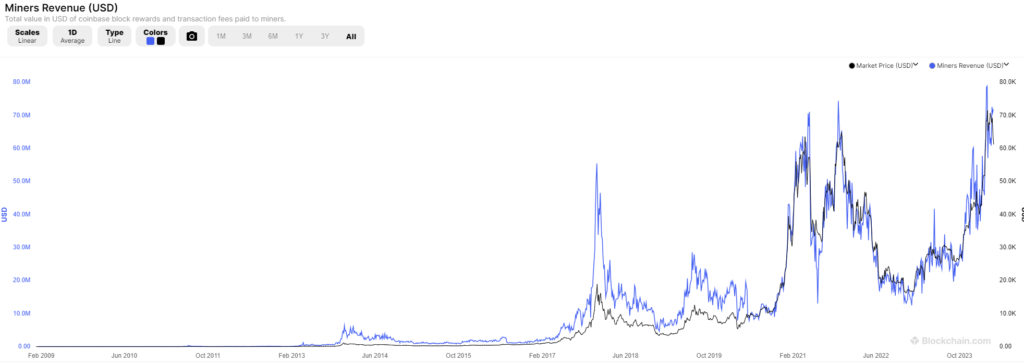

But here’s the rub: miners aren’t exactly sitting on a beach sipping Mai Tais funded by their Bitcoin bounty. They’re running massive server farms that guzzle electricity like a frat house after keg week. These energy costs are a constant drain, forcing miners to become, well, the reluctant bartenders of the Bitcoin saloon.

They churn out new Bitcoins, sure, but a good chunk of those coins go straight towards paying the electricity bill. This constant selling pressure is a fact of life in the Bitcoin game.

Think of it this way: Imagine you win the lottery, but you gotta hand over half your winnings to your power-hungry roommate who spent the entire night cranking the AC. Not exactly a recipe for early retirement.

So, miners are forced sellers, a constant undercurrent of selling pressure in the Bitcoin market. But fear not, intrepid investor! This selling pressure also has a silver lining. It incentivizes miners to keep the network secure and efficient. After all, a secure network translates to a more valuable Bitcoin, which ultimately benefits everyone (except maybe for the poor schmuck paying the electricity bill).

In the next chapter, we’ll explore the real mind-bender: Has the Bitcoin Halving Already Been Priced In? Can the market possibly predict this miner-induced selling pressure, or are we all in for a wild ride?

Demystifying Daily Bitcoin Issuance: Separating Fact from Speculation

Buckle up for a data detour related to the Bitcoin Halving! While diving into the exact daily demand for Bitcoin over the past 6 months is a tricky proposition (more on that later), we can certainly explore the supply side – namely, the issuance of new Bitcoins.

Here’s the beauty of Bitcoin: its issuance schedule is transparent and predictable. Thanks to the magic of the halving, the number of new Bitcoins entering circulation every day is a known quantity.

Finding the Daily Issuance:

Several resources can help you track Bitcoin’s issuance. Here are a couple of options:

- Blockchain.com: https://www.blockchain.com/explorer offers a block explorer with a wealth of information, including daily block rewards.

- Glassnode Studio: https://studio.glassnode.com/metrics?a=BTC&m=supply.Active6M12M provides charts and data on Bitcoin’s supply dynamics, including issuance.

The Bitcoin Halving’s Impact:

The last halving occurred around May 12th, 2020. This means the current block reward is 6.25 Bitcoins. The next Halving occurs TODAY, April 19th, 2024, in a couple of hours

With an average block time of roughly 10 minutes, there are approximately 144 blocks mined per day. So, doing the math, new Bitcoins are entering circulation at a rate of:

Daily Issuance = Block Reward * Blocks per Day Daily Issuance = 6.25 BTC * 144 blocks/day Daily Issuance = 900 BTC/day (approximately)

A Caveat on Daily Demand:

Unfortunately, gauging the exact daily demand for Bitcoin is a more complex beast. Unlike the predictable issuance, demand fluctuates based on various factors like investor sentiment, regulations, and adoption by institutions and retail buyers.

While tools like on-chain transaction volume data can offer insights into overall network activity, they don’t directly translate to new demand entering the market every day.

The Takeaway:

We can definitively track Bitcoin’s daily issuance thanks to its transparent design. However, pinpointing daily demand requires a more nuanced approach, considering various market forces.

In the next chapter, we’ll tackle the million-dollar question: Has the Bitcoin Halving Already Been Priced In? Armed with our newfound knowledge of issuance, we can dive into the complex interplay of supply and demand in the Bitcoin market.

The Halving: Priced In or Party Time? The HODLers vs. The Efficient Market Hypothesis

We’ve reached the million-dollar question: has the Bitcoin halving already been priced in by the market? This is a debate that could keep philosophers up at night, but fear not, let’s delve into the opposing camps with the wit of a seasoned trader and the wisdom of a grumpy old hodler (holder).

The Efficient Market Hypothesis: The “Priced In” Posse

In one corner, we have the efficient market hypothesis (EMH) camp. These folks believe the market is all-knowing, a giant psychic sponge that has already absorbed every scrap of information about the halving – including the impact on future supply. In their world, the price already reflects this decreased issuance, leaving little room for dramatic post-halving price surges.

Hold on to Your Hats, Here Come the HODL Waves!

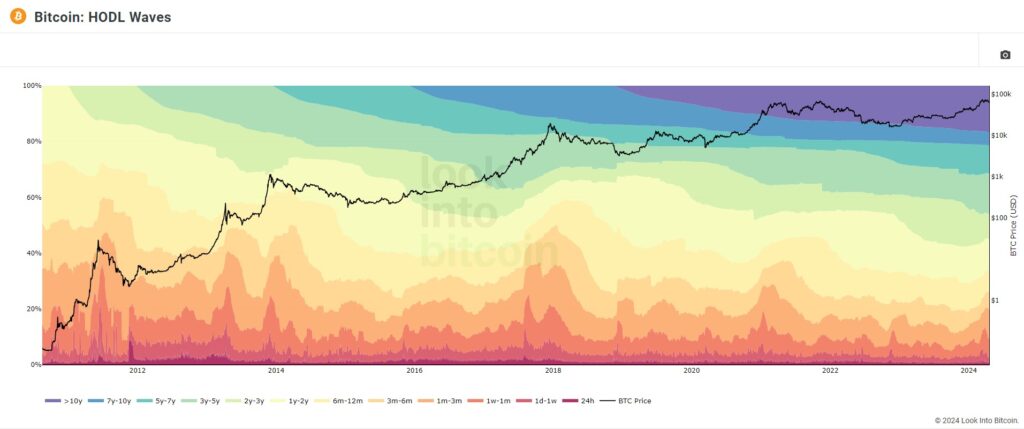

But wait! In the other corner, we have the not-so-efficient reality – the land of the HODLers. These are the believers, the champions of digital gold, who have been accumulating Bitcoins for years, taking them off the market and restricting supply even before the halving.

Now, here’s the kicker: investor behavior, my friends, is anything but efficient. Emotions, FOMO (fear of missing out), and that good old-fashioned greed can throw a massive wrench into the EMH’s perfectly logical machine.

Imagine a long line of thirsty people waiting for a limited edition lemonade stand. The EMH would say the price perfectly reflects this limited supply. But what if, when the stand opens, everyone rushes in, driven by a collective thirst? Suddenly, that lemonade becomes a lot more valuable, wouldn’t you say?

The HODLer Advantage: A Dam Holding Back the Flood

The same principle applies to the Bitcoin Halving. The HODLers, with their unyielding grip on their coins, have essentially created a dam, restricting supply. The halving further pinches the flow. This could very well lead to a scenario where demand surges past the limited supply available on exchanges, causing a price jump that the EMH might not have fully anticipated.

So, Has the Halving Been Priced In?

The truth, like most things in life there are probabilities. The EMH makes a compelling case, but it underestimates the power of human emotions and the dam effect created by the HODLers. If the past echos anything like the future, the emotions of markets and the growing utility of bitcoin in larger and larger pools of capital will show us definitively the Havling is NOT Priced IN!

The Verdict: Buckle Up!

Whether the Bitcoin halving has been priced in or not remains to be seen. One thing’s for sure, though: the upcoming party promises to be a wild ride. So, grab your metaphorical cowboy hats, adjust your risk tolerance levels, and get ready for the Bitcoin halving!

Side Note: Halving vs. Halvening? The Great Vowel Debate

Ah, the age-old question that has sparked more internet arguments than a cat video compilation – is it “halving” or “halvening”? Fear not, intrepid crypto explorers, for I come bearing the wisdom of a seasoned meme veteran.

The truth is, both terms are technically correct. “Halving” is the more traditional and widely accepted term, following the well-established verb “to halve.” But “halvening” has emerged as a more playful, community-driven term within the crypto sphere.

Think of it this way: “halving” sounds official, like a stuffy professor in a tweed jacket. “Halvening,” on the other hand, is the rebellious younger sibling, all slang and internet lingo.

So, which one should you use? The answer, my friend, is whichever tickles your linguistic fancy. Just be prepared for a playful debate from the opposing camp – it’s practically a rite of passage!

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

Leave a Reply