Introduction

As a researcher with a background in technology, economics, and historical analysis, I’ve long been fascinated by the intricate relationship between currency and human well-being. Throughout history, the specter of currency devaluation has loomed large, wreaking havoc on economies and disproportionately impacting the most vulnerable. This article delves into this complex issue, drawing upon historical examples, both recent and remote, to illuminate the devastating consequences of manipulated fiat currencies, particularly for the developing world.

Our exploration begins with the most modern manifestations of this phenomenon, before tracing its destructive path backwards through time. By examining specific historical cases, we will build a compelling case that aligns with the writings of human rights activist Alex Gladstein, who argues that the historical manipulation of fiat currencies has exacerbated social and economic inequalities. Through this analysis, we aim to demonstrate how Bitcoin, with its promise of a decentralized and immutable monetary system, offers a potential solution to this long-standing problem.

Recent Devaluations (2004-2024): A Glimpse into the Nightmare

The past two decades have seen numerous countries grapple with the devastating consequences of currency devaluation. This phenomenon, often triggered by a combination of economic mismanagement, political instability, and external pressures, has disproportionately impacted developing nations, eroding purchasing power and exacerbating social inequalities. Let’s delve into a few stark examples:

- Argentina (2018-present): Argentina’s peso has been in a state of near-constant devaluation for decades, but the crisis intensified in 2018. By 2 (as of April 2024), the Argentine peso has lost a staggering 89% of its value compared to the US dollar. This hyperinflation has eroded the savings and purchasing power of ordinary Argentines. Many have turned to holding US dollars for stability, further weakening the peso and creating a vicious cycle.

- Venezuela (2014-present): Similar to Argentina, Venezuela’s economic mismanagement and reliance on oil exports led to a severe economic crisis. Starting in 2014, the Venezuelan bolivar began a precipitous decline. By 2023, estimates suggest the bolivar had lost a mind-boggling 99.99% of its value compared to the US dollar. This hyperinflation rendered the currency practically worthless, leading to shortages of basic necessities and a mass exodus of Venezuelan citizens seeking economic refuge elsewhere.

- Turkey (2018-present): Turkey’s lira has experienced significant devaluation in recent years. Political instability, rising interest rates in the US, and a large current account deficit all contributed to the decline. Between 2018 and 2024, the Turkish lira has depreciated by approximately 75% against the US dollar. This devaluation has led to higher import prices, further fueling inflation and squeezing household budgets. Turkish businesses have also struggled with rising costs of imported goods, impacting their competitiveness.

- South Sudan (2011-present): Following its independence in 2011, South Sudan faced a unique challenge. Lacking its own established currency, it initially adopted the Sudanese pound. However, political tensions with Sudan and a reliance on oil exports led to economic instability. In 2011, South Sudan introduced its own currency, the South Sudanese Pound (SSP), which has since experienced significant devaluation. By 2024, estimates suggest the SSP has lost around 80% of its value compared to the US dollar. This has hampered economic development and exacerbated poverty in this young nation.

These are just a few recent examples of how currency devaluation can wreak havoc on economies and societies. In the next section, we will delve further back in history to explore the long shadow of devaluations on the global stage.

Devaluation’s Scars: A Historical Journey (1950-2000)

The nightmare of currency devaluation extends far beyond recent headlines. Throughout the latter half of the 20th century, numerous countries grappled with the economic fallout of manipulated currencies. Let’s explore some significant cases:

- The Great British Pound Devaluation (1967): In an attempt to address a growing balance of payments crisis, the British government devalued the pound by 14% against the US dollar. This move aimed to make British exports cheaper and imports more expensive, boosting domestic production. However, the devaluation triggered a wave of inflation, eroding purchasing power and leading to social unrest.

- The Mexican Peso Crisis (1982 & 1994): Mexico experienced two major currency crises in this period. In 1982, following years of excessive government spending and a reliance on oil exports, the peso lost a staggering 80% of its value compared to the dollar. This hyperinflation devastated the Mexican economy, leading to widespread poverty and social unrest. A similar crisis unfolded in 1994, with the peso losing another 50% of its value, highlighting the long-term vulnerability of the Mexican economy.

- The 1997 Asian Financial Crisis: This regional crisis had a domino effect on several Southeast Asian currencies. Currencies like the Thai baht and Indonesian rupiah lost over 50% of their value against the US dollar within a short period. The crisis stemmed from a combination of factors, including overvalued currencies, speculative attacks, and fragile financial systems. The economic fallout was severe, leading to widespread bankruptcies, unemployment, and social unrest across the region.

These historical examples illustrate the devastating consequences of currency devaluation. Beyond the immediate economic hardships, these events can have a long-lasting impact on a nation’s social fabric and development trajectory. Eventually, we will explore how Bitcoin, with its promise of a decentralized and inflation-resistant currency, offers a potential solution to this historical challenge.

Devaluation’s Echoes Through Time (1 AD – 1900s)

The specter of currency devaluation has haunted societies for centuries, long predating the rise of the US dollar as a global reserve currency. Let’s delve into some historical examples, even if direct comparisons to the dollar are not always possible:

- The Debasement of the Roman Denarius (3rd Century AD): The Roman Empire, facing chronic military expenses and economic pressures, began systematically reducing the silver content of the denarius, its primary coin. This debasement, estimated at around 75% over a century, fueled inflation and eroded purchasing power. Ordinary Romans struggled to afford basic necessities, contributing to social unrest and ultimately, the decline of the empire.

- The Song Dynasty Cash Crisis (11th-13th Centuries AD): China’s Song Dynasty heavily relied on paper money, or Jiaozi. However, excessive printing to finance wars and government projects led to a dramatic decline in the value of Jiaozi. By the 13th century, estimates suggest it had lost over 90% of its purchasing power, crippling trade and economic activity. This crisis serves as a historical cautionary tale about the dangers of uncontrolled money printing.

- The Clipping and Debasement of European Coinage (14th-17th Centuries AD): European monarchs frequently resorted to clipping coins (removing precious metal) and reducing their metal content to finance wars and courtly extravagance. This manipulation eroded public trust in currencies, hindered trade, and fueled inflation. The economic instability it created contributed to social unrest and hampered economic development.

- The Hyperinflation of the Weimar Republic (1914-1923): Following World War I, Germany faced crippling reparations and resorted to printing massive amounts of marks to pay its debts. This triggered hyperinflation, with the mark losing an estimated 99.99% of its value within a few years. Basic necessities became astronomically expensive, and social order nearly collapsed. The experience of the Weimar Republic stands as a stark reminder of the devastating consequences of uncontrolled money printing.

These historical examples illustrate that currency devaluation is not a new phenomenon. While direct comparisons to the US dollar may not be applicable, the historical record is replete with instances where debasement and manipulation of currencies eroded purchasing power, crippled trade, and fueled social unrest.

The Devaluation Nightmare in Africa

The African continent has a long and complex history with currency devaluation. Here, the consequences often hit developing economies particularly hard, disproportionately impacting the most vulnerable populations. Let’s look at a few stark examples:

- Ghana (1970s-present): Ghana’s cedi has been plagued by devaluation for decades. In the 1970s, a combination of factors like overspending, cocoa price slumps, and external debt led to a series of devaluations. By 1982, the cedi had lost over 90% of its value compared to the US dollar. This hyperinflation devastated Ghanaians, making basic necessities unaffordable and eroding savings. While the situation has improved somewhat, the cedi continues to face devaluation pressures, hindering economic stability.

- Zaire (now Democratic Republic of Congo) (1990s): The Mobutu Sese Seko regime in Zaire (now the Democratic Republic of Congo) engaged in rampant money printing to finance its lavish lifestyle and military campaigns. This resulted in hyperinflation in the 1990s, with the Zairian new zaire losing a staggering 99.9% of its value compared to the US dollar. People resorted to bartering basic goods, and the economy collapsed. The scars of this hyperinflation are still felt today, hindering investment and economic development.

- Zimbabwe (2000s): Zimbabwe’s economic mismanagement and controversial land reforms led to a hyperinflationary spiral in the 2000s. The Zimbabwean dollar became practically worthless, with estimates suggesting it lost over 99.99% of its value compared to the US dollar within a few years. Millions of Zimbabweans fled the country seeking economic opportunities elsewhere. While the country has since adopted a multicurrency system, the psychological trauma and economic instability caused by hyperinflation continue to cast a long shadow.

These are just a few examples of how currency devaluation has wreaked havoc on African economies and the lives of its citizens. The erosion of purchasing power, collapse of savings, and disruption of trade all contribute to a decline in living standards and hinder long-term development prospects. In the next section, we will explore how Bitcoin, with its promise of a decentralized and inflation-resistant currency, offers a potential alternative for the future.

The Devaluation Dilemma in Communist Regimes

Communist economies, with their focus on central planning and state control, were not immune to the pitfalls of currency devaluation. Here, we’ll explore how attempts to manipulate currencies within these systems often backfired, causing hardship for citizens.

- The Soviet Union (1970s-1990s): The ruble, the official currency of the Soviet Union, was pegged to a fixed exchange rate with the US dollar. This system, however, became increasingly unsustainable as the Soviet economy stagnated. Shortages of goods became commonplace, and the black market flourished. By the 1980s, the black market exchange rate for the ruble had plummeted to a fraction of its official rate. Estimates suggest it could take 20 or more rubles to purchase a single US dollar on the black market, highlighting the vast devaluation experienced by Soviet citizens. This eroded purchasing power for basic necessities and contributed to a decline in living standards.

- Poland (1970s-1980s): Poland’s communist government attempted to maintain artificially low prices for consumer goods. This, combined with excessive borrowing and inefficient state-run enterprises, led to chronic shortages and a black market. The zloty, the Polish currency, lost significant value on the black market, creating a vast discrepancy between the official and true exchange rates. In the 1980s, estimates suggest the black market exchange rate could be 10 times the official rate, highlighting the true devaluation experienced by Polish citizens. This disparity fueled social unrest and ultimately contributed to the rise of the Solidarity movement in the 1980s.

- East Germany (1949-1990): The East German mark (Ostmark) was not freely convertible and existed in a separate economic sphere from the West German Deutschmark. Despite official pronouncements of parity, the Ostmark’s true value was much lower. This devaluation was particularly evident in the thriving black market for Western goods. East Germans with access to hard currency, like the Deutschmark, could obtain far more desirable goods. Estimates suggest the black market exchange rate for the Ostmark could be 10 or more times the official rate, highlighting the limitations of the communist economic system.

These examples showcase the challenges faced by communist economies in maintaining stable currencies. The artificial manipulation of exchange rates often led to a disconnect between official pronouncements and the reality experienced by citizens. Shortages, black markets, and a decline in purchasing power all became hallmarks of these devaluations, contributing to social unrest and ultimately, the downfall of some communist regimes.

The Middle East’s Devaluation Woes: A Recurring Nightmare

The Middle East, a region rich in natural resources, has also grappled with the devastating consequences of currency devaluation. Here, we explore how economic mismanagement, political instability, and external pressures have combined to erode purchasing power and destabilize economies.

- Iran (1979-present): Following the Iranian Revolution in 1979, the Iranian rial came under immense pressure. The combination of war with Iraq, economic sanctions, and government mismanagement led to a significant devaluation. By 2024, estimates suggest the Iranian rial has lost over 99% of its value compared to the US dollar. This hyperinflation has crippled the Iranian economy, making basic necessities unaffordable for many citizens. The government’s attempts to control currency exchange rates have largely failed, creating a thriving black market for foreign currency.

- Iraq (1990s-present): The economic sanctions imposed on Iraq following the Gulf War, coupled with years of dictatorship and internal conflict, severely weakened the Iraqi dinar. By 2003, the dinar had lost an estimated 99.9% of its value compared to the US dollar. Hyperinflation ravaged the Iraqi economy, leading to shortages of basic necessities and widespread hardship. While some economic recovery has occurred under the post-war government, the dinar remains vulnerable to devaluation pressures due to ongoing political instability and reliance on oil exports.

- Lebanon (1980s-present): Lebanon’s civil war (1975-1990) and subsequent political instability triggered a long period of currency devaluation. The Lebanese pound has lost a staggering 98% of its value compared to the US dollar since the 1980s. This devaluation, compounded by a banking crisis in 2019, has plunged Lebanon into a deep economic depression. Millions of Lebanese citizens now live in poverty, struggling to afford basic necessities like food and medicine. The devaluation has also fueled social unrest, highlighting the devastating human cost of a failing currency.

These are just a few examples of how currency devaluation has wreaked havoc on Middle Eastern economies and societies. The erosion of purchasing power, capital flight, and social unrest are all hallmarks of these devaluations. In the next section, we will explore how Bitcoin, with its promise of a decentralized and inflation-resistant monetary system, offers a potential path forward for these countries.

Bitcoin: A Potential Lifeline in the Devaluation Maelstrom?

Throughout history, the specter of currency devaluation has cast a long shadow, trapping billions in poverty and hindering economic development. But with the advent of Bitcoin, a revolutionary technology has emerged, offering a potential solution to this age-old problem.

Bitcoin, the world’s first decentralized digital currency, operates on a blockchain network, a distributed ledger secured by cryptography. This eliminates the need for a central authority to control the money supply, a key factor contributing to devaluation in traditional fiat currencies. Bitcoin’s revolutionary aspect lies in its capped supply – only 21 million Bitcoins will ever be mined. This built-in scarcity acts as a hedge against inflation, potentially offering a store of value that is secure and predictable, unlike currencies susceptible to manipulation.

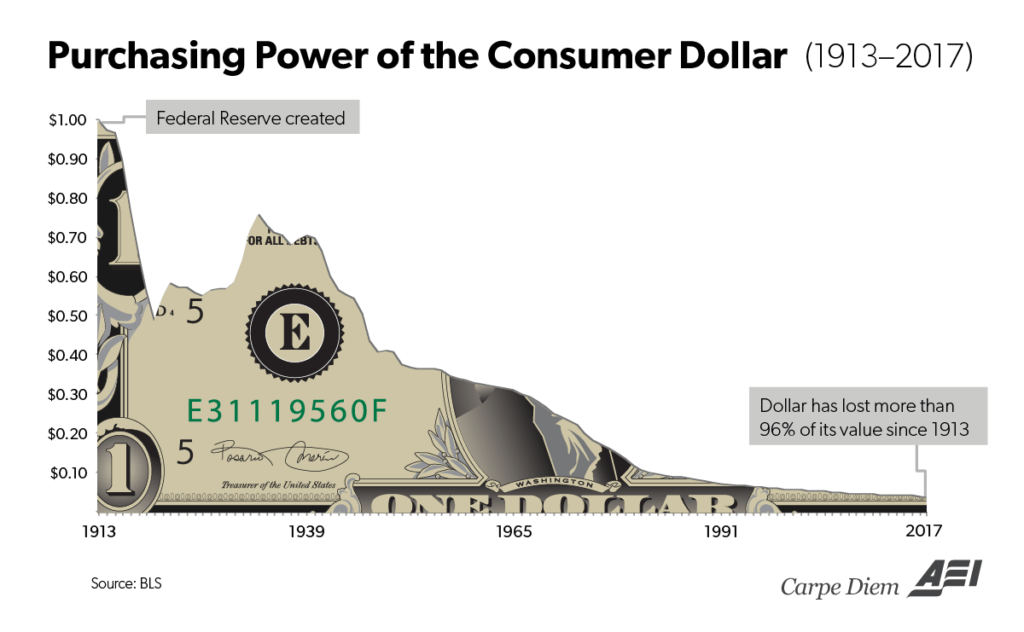

The Dollar’s Decline: A Bitcoin Rise

For context, consider the dramatic shift in value between the US dollar and Bitcoin since its inception. In 2008, when Bitcoin was first created, its value was negligible. According to Forbes: https://www.forbes.com/advisor/money-transfer/currency-converter/usd-btc/, in July 2010, 1 US dollar could buy over 1,200 Bitcoins. By April 2024, however, the story has flipped entirely. Today, 1 US dollar translates to a fraction of a Satoshi (one hundred millionth of a Bitcoin), highlighting the immense appreciation of Bitcoin compared to the devaluation of the US dollar. This extraordinary price increase suggests Bitcoin’s potential as a hedge against inflation and a store of value that is demonstrably more secure than traditional fiat currencies susceptible to manipulation.

For individuals living in countries ravaged by devaluation, Bitcoin offers a glimmer of hope. It provides a secure, unconfiscatable way to store wealth. Unlike local currencies that can lose value overnight, Bitcoin can potentially act as a hedge against inflation, preserving purchasing power over time. This financial security empowers individuals to escape the cycle of poverty and participate more fully in the global economy.

To be very clear and sensitive to the situation, we know that individuals facing this type of rampant devaluation are not often thinking about Bitcoin, but rather how they can survive and feed their families. However, I believe that as Bitcoin develops and matures this option will become more and more clear, viable, and offer tremendous hope to those trapped in these horrific situations.

Beyond individual empowerment, Bitcoin’s potential to transform global economic structures is profound. By facilitating secure and transparent cross-border transactions with minimal fees, Bitcoin could revolutionize trade, particularly for developing nations. This could unleash a wave of economic activity, boosting productivity and fostering a more flourishing global marketplace.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

Leave a Reply