In the pandemic world of 2020, investors are asking what is the better investment Bitcoin or Tesla? In the following article, I’ll give 3 factors to look at as an investor. Buckle up for the showdown – Bitcoin Vs Tesla 2020!

Bitcoin vs Tesla – Technical Performance

- Bitcoin (BTC) 2020 – Up +65%*

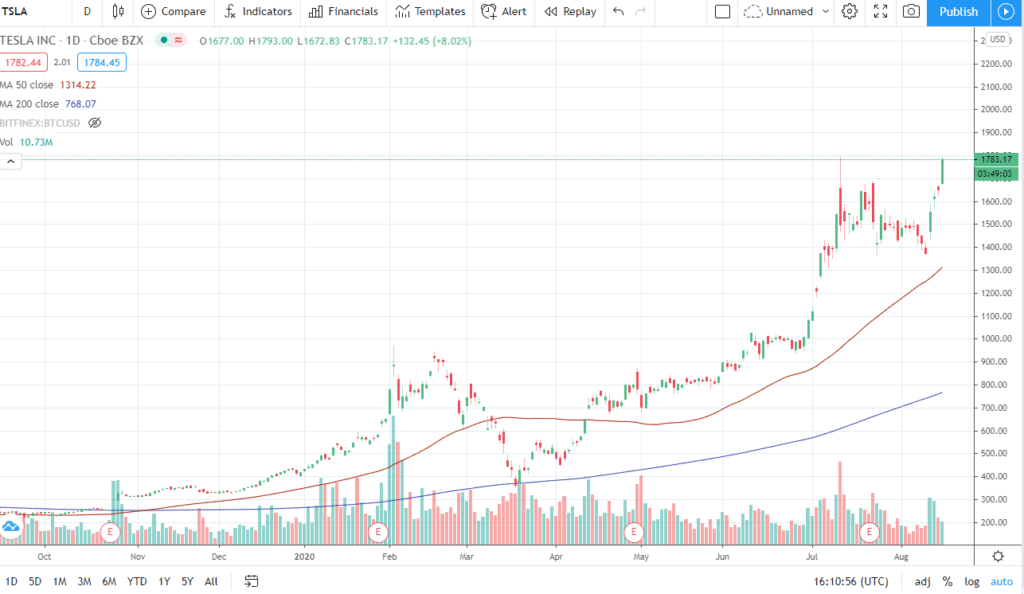

- Tesla (TSLA) – Up +294.78%*

So far YTD Tesla investors have crushed it with some major price appreciation. Bitcoin performance hasn’t been too shabby either. Let’s take a look at the charts.

Both Bitcoin and Tesla have had an interesting year. The coronavirus sent nearly all asset classes into a tumble in early March.

Both Bitcoin and Tesla got hit pretty hard and took 63% declines in early March.

Tesla came back with a vengeance going parabolic into July. The unbridled enthusiasm for Tesla began to taper but then came back with a vengeance as Elon Musk announced a potential stock split.

The split in mind was a five for one split making shares more affordable for the average investor.

Tesla is flirting with all time highs as I write this. The price action off the split announcement is very bullish!

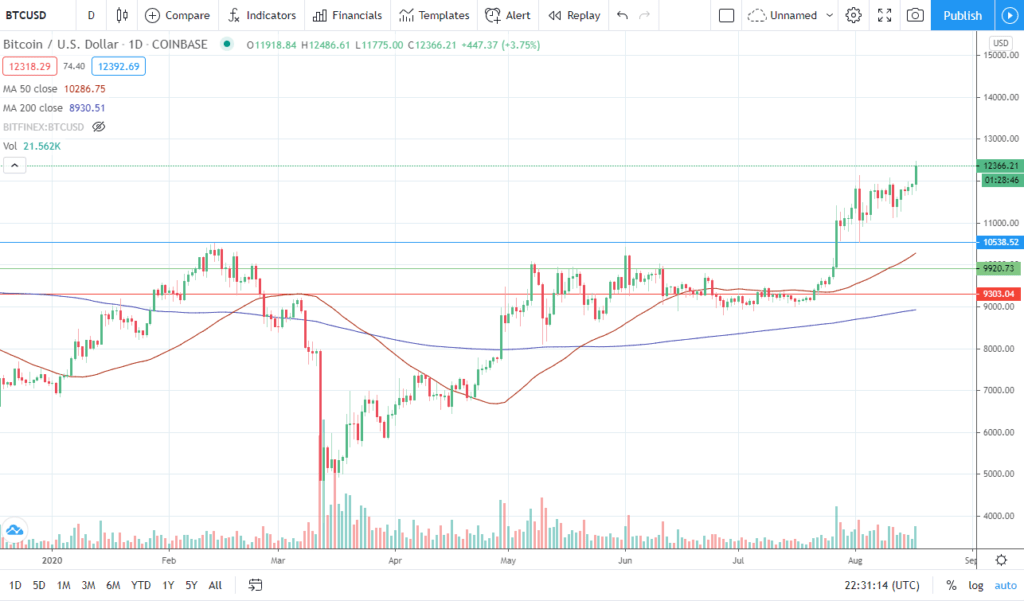

Bitcoin also climbed out of the coronavirus pandemic shock with impressive strength. Price action hasn’t been as parabolic as Tesla, but has shown signs of an emerging bull market.

As we speak Bitcoin just broke out of some major resistance at 12K. Bitcoin is also looking bullish!

Winner – Technical Performance: Tesla

Bitcoin vs Tesla – Macro Narrative

The government actions taken to curb the spread Covid-19 have created a macro environment that is unprecedented in recent history.

Central banks and governments have issued massive economic stimulus packages to help float businesses through these challenging times.

All of the money printing has investors concerned about inflation and asset allocation.

The actions of the Fed has received some wild results. Investors have run to asset markets to park their money and are anxious to get out of cash. Cash is trash!

The markets are looking at all-time highs. Tech stocks, gold, and Bitcoin are all booming. Low-interest rates and cheap money are even propping up real estate.

However, all of this bullish asset action isn’t supported by the reality of the economic situation.

The IMF shows the US being down -5.9 in GDP for 2020. In Q2 of 2020, the US was down -32.9% GDP.

Unemployment is at record setting horrendous numbers.

Overall consumption is way down and saving rates are up.

Clearly a company like Tesla presents a great place to allocate funds in this environment. Their product is extremely hot right now and because it is a luxury item isn’t as affected by the virus.

When true economic hardship starts to hit the world int he coming months, is Tesla going to hang in there? Time will tell.

The macro narrative couldn’t be more bullish for Bitcoin. Bitcoin is designed for saving. The true Hodlers of Bitcoin know that Btc was built as a hedge to the institution of fiat money.

With investors running to asset markets to try and save their finances from being devalued into worthless pieces of paper Bitcoin presents itself as an incredible opportunity.

Winner – Macro Narrative: Bitcoin

Bitcoin vs Tesla – Risk / Reward Opportunity

When a stock is going parabolic it is tempting to get in on the action. Riding a quick trend and trading a nice break out can present a low-risk trading opportunity for a quick profit.

If you are a short term trader at these levels Tesla could present some interesting opportunities. However, as this blog is an investing focused, we’ll stick with long term outlook.

Tthe asymmetric nature of Bitcoin’s historical price action gives BTC a long term edge over Tesla.

It looks like we have a good base of support at $10,500. $9,900, and about $9,300. With Bitcoin breaking the 12,000 barrier and rocketing up through its long term bear trend, your downside can be managed.

With Bitcoin’s history of going parabolic and its overall value proposition. I’ll be looking for massive growth as the bull run continues. I wouldn’t be shocked to see Bitcoin in the range from $21,000 to $28,000 by the end of the year!

Winner – Risk / Reward Opportunity: Bitcoin

Summary

In summary, I believe BOTH Tesla and Bitcoin are awesome investments right now. Clearly, Tesla has won the first half of 2020. The second half is yet to be determined, but I’m giving a slight edge to Bitcoin to pull out a great end of year finish. Happy Investing!

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.

*As of August 15th 2020.

*https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD

*https://seekingalpha.com/article/4367950-will-u-s-economic-rebound-falter-in-2020s-second-half