Bitcoin Supply Side Economics

Bitcoin is a digital currency that was created in 2009 by an anonymous person or group of people under the name Satoshi Nakamoto. Bitcoin is not controlled by any central bank or government, and it is not subject to inflation. To be more specific Bitcoin’s protocol is inflationary but that decreases with time creating price stability.

These facts are what makes Bitcoin fascinating from a macro economic perspective. The creation of which changes completely reversed our economic models.

The supply of Bitcoin is limited to 21 million coins. This means that there is a finite amount of Bitcoin that will ever be created. As the demand for Bitcoin increases, the price will rise.

This is completely the opposite of fiat money, which expands at an ever more rapid rate. This gives Bitcoin it’s unique stance as the antidote to our current system.

The programmed schedule of Bitcoin issuance

The Bitcoin protocol is programmed to issue new Bitcoin at a fixed rate. The first block of Bitcoin was mined on January 3, 2009, and it contained 50 BTC. Every 210,000 blocks, or approximately every four years, the reward for mining a block is halved. This means that the total supply of Bitcoin will never exceed 21 million coins. (Technically the total amount is just shy of 21 million)

The programmed schedule of Bitcoin issuance has a number of implications for the Bitcoin economy.

- It creates a predictable supply of Bitcoin. This makes Bitcoin a more attractive store of value than assets with unpredictable supply, such as fiat currencies.

- It incentivizes miners to secure the Bitcoin network. Miners are rewarded with Bitcoin for their work, and the more Bitcoin they mine, the more they earn. This competition to mine Bitcoin helps to secure the network by making it more difficult for attackers to take control of it.

- It creates deflationary pressure on Bitcoin prices. As the supply of Bitcoin decreases, the demand for Bitcoin is likely to increase, which leads to higher prices.

How the programmed schedule of Bitcoin issuance affects market participants

The programmed schedule of Bitcoin issuance affects market participants in a number of ways.

- Miners: Miners are the people who use computers to solve complex mathematical problems in order to add new blocks to the Bitcoin blockchain and earn Bitcoin as a reward. The programmed schedule of Bitcoin issuance means that the rewards for mining Bitcoin will decrease over time. However, as the price of Bitcoin increases, there will be more incentive to participate in the Bitcoin ecosystem, which will lead to more miners joining the network. This will increase the difficulty of mining Bitcoin, but it will also increase the rewards for mining Bitcoin. As a result, the profitability of mining Bitcoin is likely to remain relatively stable over time.

- Exchanges: Exchanges are businesses that allow people to buy, sell, and trade Bitcoin. The programmed schedule of Bitcoin issuance could lead to increased demand for Bitcoin on exchanges, as people may be looking to buy Bitcoin before the next halving event. This could lead to higher prices on exchanges.

- Wallet providers: Wallet providers are businesses that allow people to store their Bitcoin. The programmed schedule of Bitcoin issuance could lead to increased demand for Bitcoin wallets, as people may be looking for a secure place to store their Bitcoin. This could lead to higher prices for Bitcoin wallets.

- Other businesses: There are a number of other businesses that participate in the Bitcoin ecosystem. These businesses include payment processors, financial institutions, and merchants. The programmed schedule of Bitcoin issuance could lead to increased acceptance of Bitcoin by these businesses, as they may see it as a more attractive investment.

The programmed schedule of Bitcoin issuance is a key feature of the Bitcoin protocol. It has a number of implications for the Bitcoin economy, and it is likely to continue to affect market participants in a number of ways in the future.

It is important to remember that all of these market participants are incentivized by Bitcoin’s success along with every holder on the demand side creating a virtuous loop of price appreciation.

Stock-to-flow ratio

The stock-to-flow ratio is a metric that compares the total supply of an asset to the amount of new supply that is generated each year. In the case of Bitcoin, the stock is the total supply of 21 million coins, and the flow is the amount of new Bitcoin that is mined each year.

The stock-to-flow ratio of Bitcoin has been increasing over time, as the amount of new Bitcoin that is mined each year decreases. This is due to the programmed schedule of Bitcoin issuance, which halves the reward for mining a block every four years.

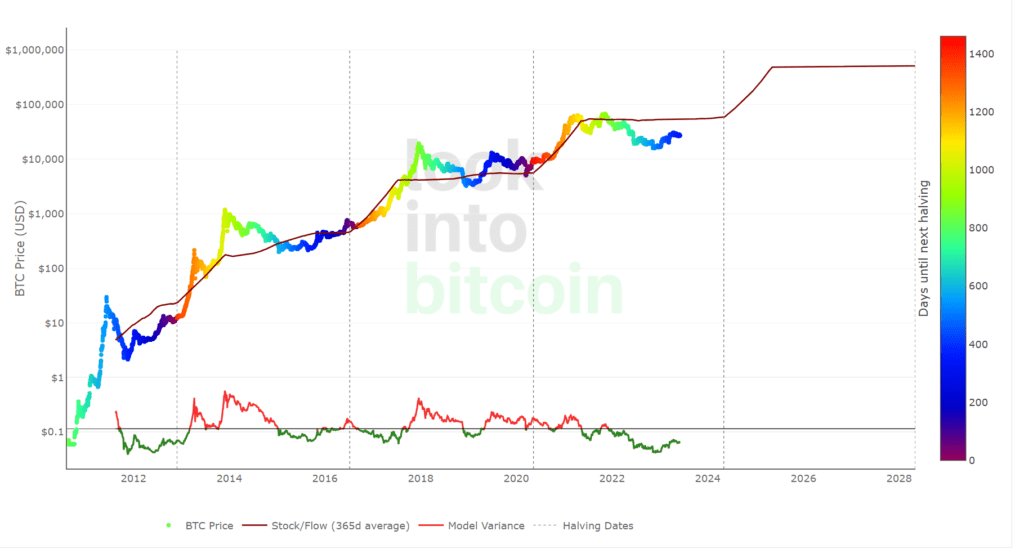

Plan B, a pseudonymous Twitter user, has popularized the use of the stock-to-flow ratio to predict the price of Bitcoin. Plan B has created a stock-to-flow model that predicts that the price of Bitcoin will increase significantly in the coming years.

The stock-to-flow model is based on the assumption that the price of Bitcoin is determined by its scarcity. As the stock-to-flow ratio increases, so too should the price of Bitcoin.

The stock-to-flow model has been criticized by some analysts, who argue that it is too simplistic and does not take into account other factors that can affect the price of Bitcoin, such as demand and supply.

Despite the criticism, the stock-to-flow model has gained a lot of popularity among Bitcoin investors. Many investors believe that the model is a reliable way to predict the price of Bitcoin in the future. You can see from the chart above, the model somewhat follows the Bitcoin price, but the specifics of which are wildly inaccurate.

Time will tell if the Stock to Flow model remains a model for the future Bitcoin price. The point being that the scarcity of the Bitcoin as it is released on a programmatic schedule creates economics around the protocol itself.

Bullish Outlook for Bitcoin

There are a number of factors that suggest that Bitcoin is likely to continue to appreciate in value in the future.

- The programmed schedule of Bitcoin issuance: As mentioned above, the programmed schedule of Bitcoin issuance creates a deflationary pressure on Bitcoin prices. This means that, over time, Bitcoin is likely to become more scarce and valuable.

- The growing adoption of Bitcoin: Bitcoin is becoming increasingly adopted by businesses and individuals around the world. As more people use Bitcoin, the demand for Bitcoin is likely to increase, which could lead to higher prices.

- The increasing institutional interest in Bitcoin: Institutional investors, such as hedge funds and pension funds, are starting to take notice of Bitcoin. As more institutional investors invest in Bitcoin, the demand for Bitcoin is likely to increase, which could lead to higher prices.

Overall, the outlook for Bitcoin is bullish. The programmed schedule of Bitcoin issuance, the growing adoption of Bitcoin, and the increasing institutional interest in Bitcoin all suggest that Bitcoin will continue to appreciate in value in the future.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.