The long-awaited arrival of physically-backed Bitcoin ETFs in the US sent shockwaves through the financial world. After years of rejected proposals, January 2024 saw the launch of the first 10 such ETFs, and the initial months have been nothing short of impressive. Let’s delve into the data to see how this new financial instrument is impacting the Bitcoin market.

Historical Demand: A Dam Breaking

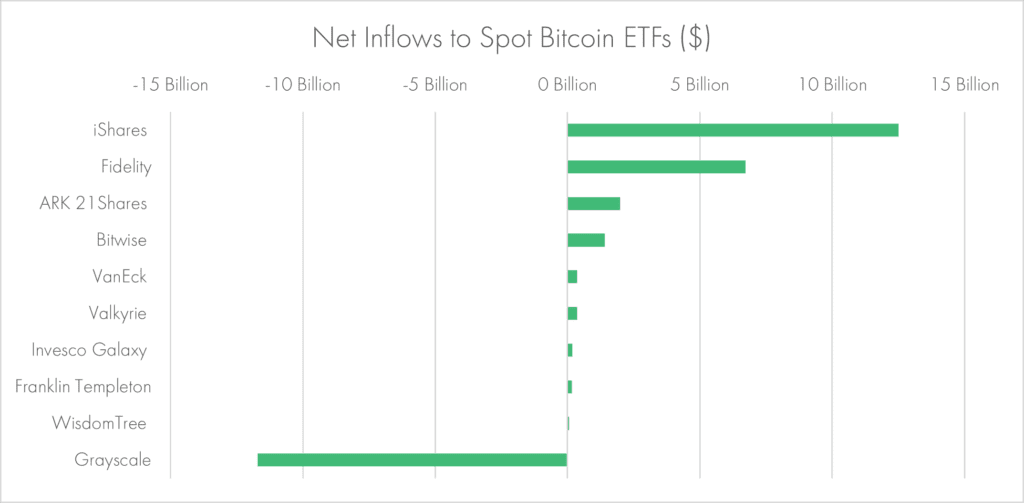

Prior to the ETF approval, the only option for gaining regulated exposure to Bitcoin was through Grayscale’s Bitcoin Trust (GBTC). However, GBTC faced structural issues that led to a premium on its net asset value (NAV). The arrival of ETFs offered a more transparent and potentially cheaper way to invest, and the demand reflected that.

The first day of trading saw record volumes, with estimates suggesting over $7.7 billion worth of Bitcoin ETFs changing hands [Cointelegraph, Spot Bitcoin ETF volumes shatter record with massive $7.7B traded]. This handily surpassed previous records and showcased the pent-up investor interest.

Net inflows, representing new money entering the ETF space, have also been strong. Data suggests a daily record of over $1 billion just weeks into launch [Cointelegraph, BlackRock’s Bitcoin ETF sets daily volume record as BTC recoups slump]. This sustained inflow indicates ongoing investor appetite for this new asset class.

Bitcoin Buying and Supply Squeeze

But what does this mean for the underlying Bitcoin itself? The ETFs directly purchase Bitcoin to meet investor demand. Estimates suggest that by March 2024, these Bitcoin ETFs held a combined 192,255 bitcoins [CoinDesk, The Bitcoin ETF Approval: Full Coverage]. This already surpasses the holdings of MicroStrategy, the previous frontrunner among publicly traded companies.

To understand the significance, let’s compare this buying to Bitcoin’s issuance. With a finite supply capped at 21 million, Bitcoin mining currently yields around 900 new coins every day. This translates to roughly 27,000 coins mined per month. The ETFs, in just a few months, have already accumulated more Bitcoin than what’s mined in over seven months – a significant chunk of the new supply.

5 Reasons Why This is Extremely Bullish for Bitcoin

- Institutional Investors Get Onboard: Bitcoin ETFs open the door for a new wave of institutional investors who were previously hesitant due to regulatory uncertainty and the complexities of managing their own Bitcoin. This broader institutional participation can significantly increase demand for Bitcoin, driving the price upwards.

- Enhanced Market Legitimacy: The SEC approval of Bitcoin ETFs represents a significant stamp of approval for the cryptocurrency. This validation from a major regulatory body can increase trust and confidence in Bitcoin, attracting a wider range of investors and potentially reducing price volatility.

- Increased Liquidity: ETFs provide a more accessible and liquid way to invest in Bitcoin compared to traditional crypto exchanges. This can attract new investors who were previously discouraged by the complexities of navigating crypto exchanges and managing private keys. Increased liquidity can lead to smoother price movements and potentially reduce volatility in the long run.

- Potential for Traditional Investment Products: The success of Bitcoin ETFs could pave the way for the development of other Bitcoin-related investment products like futures contracts and options. This broader financial ecosystem can further increase investor interest and provide sophisticated tools for managing risk and exposure to Bitcoin.

- Benchmarking and Broader Recognition: Bitcoin ETFs can act as a benchmark for the cryptocurrency, making it easier for investors to track its performance and compare it to other asset classes. This increased recognition can further legitimize Bitcoin as an investable asset and attract a wider range of participants to the market.

The Future Unfolds

It’s still early days for Bitcoin ETFs, and the long-term impact remains to be seen. However, the initial data paints a picture of strong investor demand and a potential supply squeeze. As Wall Street grapples with this new dynamic, Bitcoin’s price movements in the coming months will be closely watched.

2 responses to “The Incredible Power of the Bitcoin ETF: The Numbers So Far and 5 Reasons This is Extremely Bullish”

[…] Click here to see how the Bitcoin ETF has done so far! […]

[…] the end fo the day each spot ETF has the potential to lock up more coins. With the way these approvals have been going, it doesn’t like there are too many more coins to go […]