GTBC Dumps

Ah, the Grayscale Bitcoin Trust (GBTC). Once the darling of the crypto crowd, it’s now facing an investor exodus faster than you can say “decentralized finance.” But why the sudden cold shoulder? Buckle up, because it’s about to get a bit wild.

GBTC’s woes extend beyond its trust structure. For years, it’s battled to become a true ETF, a regulatory hurdle that would grant it greater access to mainstream investors. This legal fight finally swung in GBTC’s favor with a recent court victory. However, the win came a little too late. The arrival of real Bitcoin ETFs has overshadowed this potential benefit, leaving many investors unimpressed with GBTC’s newfound ETF status. It seems, in the land of crypto, timing is everything.

GBTC’s fees are significantly higher than newer, sleeker Bitcoin ETFs that have hit the market. Enter James Seyffart, a crypto analyst who likes numbers more than a toddler likes Legos. He predicts that a massive chunk of investors, somewhere in the ballpark of 60%, will ditch GBTC in favor of these swifter, cheaper options.

Bitcoin ETF Alternatives

So, what are these Bitcoin ETF alternatives offering? Well, they’re the real deal – actual ETFs that directly track the price of Bitcoin. Think shiny, new Bitcoin sports cars compared to GBTC’s dented jalopy. Here’s a quick breakdown of the new kids on the block:

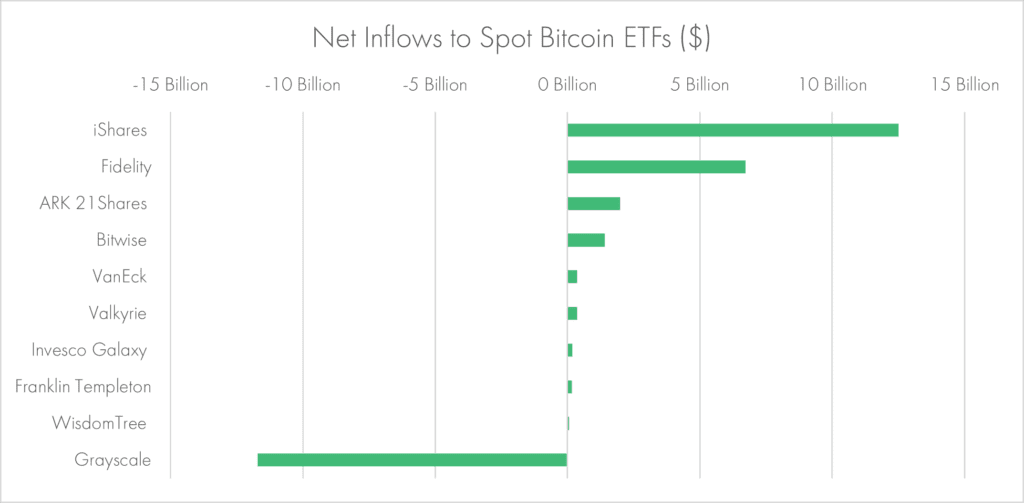

- BlackRock’s iShares Bitcoin Trust ETF (IBIT): Launched in January 2024, IBIT boasts a rock-bottom expense ratio, making it a penny pincher’s paradise. So far, it’s accumulated a cool $10 billion in assets, proving it’s not all flash and no cash.

- ProShares Bitcoin Strategy ETF (BITO): Another January 2024 arrival, BITO focuses on daily exposure to Bitcoin futures contracts. Think of it like a high-octane way to play the Bitcoin game, with assets already surpassing $8 billion.

The Future for Bitcoin ETFs

Now, the future? Let’s call it the “Great Bitcoin ETF Shakeup.” As investors continue to flock to cheaper, more efficient options, GBTC’s premium over the actual price of Bitcoin is likely to shrink further. This could put downward pressure on the entire Bitcoin market, but fear not, true believers! The overall trend for Bitcoin is still positive, and this shakeup might just be a healthy dose of market correction.

What happens when GBTC selling stops? At the beginning of 2024 GBTC held approximately 620,000 Bitcoin. GBTC currently holds over 310,000 Bitcoin. Their holding have been cut in half! Yet the price of Bitcoin has performed very well this year as other funds have gobbled up the coinage.

So, the moral of the story? Do your research, folks! Don’t get stuck holding the GBTC bag when there are faster, cheaper Bitcoin ETFs on the market. The future of Bitcoin is bright, but for GBTC, things might be a little less rosy.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research.