What does Bitcoin have to do with Minimalism? More than meets the eye. In this article, we are going to be diving into the philosophies driving both and how they meet in a strange harmony to benefit the individual investor.

What is Minimalism?

Imagine a plain white room, no windows, no art on the walls, and one very hard wooden chair in the middle. Doesn’t that sound awesome?!

I’m not talking about minimalist style or decor but rather the movement of minimalist thinking popular with Millennials and gen Y today.

Minimalism as defined by the author of Becoming Minimalist blog, Joshua Becker, is –

“It is marked by clarity, purpose, and intentionality. At its core, minimalism is the intentional promotion of the things we most value and the removal of everything that distracts us from it. It is a life that forces intentionality. And as a result, it forces improvements in almost all aspects of your life.”

Joshua Becker

Minimalists seek to remove all that is unnecessary so they can focus on what is essential in their life. In modern-day society, we are confronted with the message that more is better.

More cars, more houses, more stuff. That leads to a better life, right?

Minimalism has become a growing movement with lifestyle hackers like Joshua Fields Millburn & Ryan Nicodemus. With their website, film, and podcast, these innovators have millions become more intentional with their time and money. The movement is growing exponentially and continues to be more popular with younger generations.

“The things you own end up owning you.”

Joshua Fields Millburn

Minimalists have hacked the code programmed into our minds by multi-million dollar ad campaigns and said enough is enough.

Is that bigger better car going to make you happier than spending more time each week playing with your kids?

Is upgrading from a 3 bedroom house to a 4 bedroom with a pool and larger mortgage, going to make you feel more fulfilled than going being completely debt-free?

Is that new Gucci purse that costs $5,000 going to make you feel better than learning yoga in Bali for a week?

Minimalists have found that they can live a far happier, fulfilled life, by focusing on their passions, interests, and people in their lives than by continually trying to climb the corporate ladder and obtain more material possessions.

However, isn’t Bitcoin seems diametrically opposed to Minimalism!?

We’re going to the moon in a Lambo, baby! Isn’t Bitcoin about sick gainz, and making more money? How do these two seemingly opposing views, meld together into a beautiful philosophy?

Why Minimalism?

Why did the Minimalist movement come about? I believe there is something beyond coincidental about the status of our economy and the rise of the minimalist movement.

Let’s take a look at some graphs that go back to 1971. This happens to be the date that the nations of the world signed the Brenton Woods agreement.

This agreement created the framework for pricing all currencies of the world to be pegged to US dollars.

In 1971, as a nation, the US completely abandoned the Gold Standard.

Up until that point, all US reserve notes were backed by their ability to be redeemed for Gold.

Under the Gold Standard, the currency was backed by a scarce asset with limited supply. All governments now operate on what is called a “fiat” system in which the money supply is not backed by anything.

With fiat money in place, this gives the government and the central banks of the world enormous power to control the economy. This comes with some serious implications.

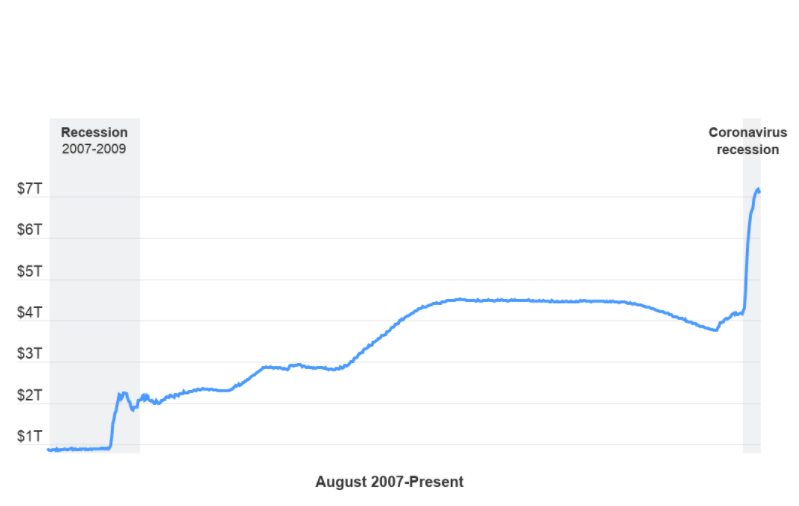

In 2020, with the Covid-19 pandemic, the US Federal Reserve has printed its way to more than $7,000,000,000,000 in dollars on their balance sheet.

The inter-workings of the fiat systems are too complex to explore in this article, but needless to say as the old economic saying goes, “there is no such thing as a free lunch.”

When the US government made the decision to move away from the gold standard, they took sovereignty away from the individual. This move puts more power into the hands of the government and equals less freedom for the citizen.

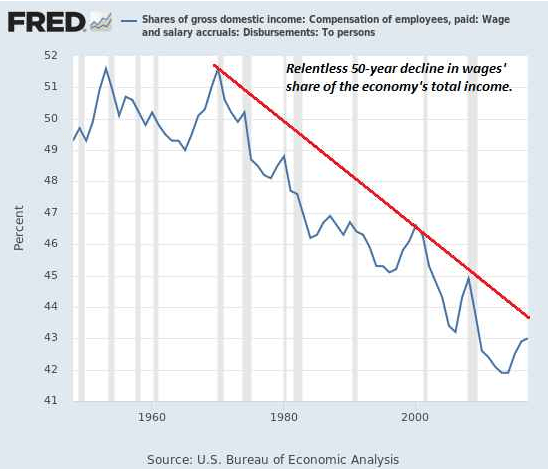

The website WTFhappenedin1971 outlines the catastrophic results of moving off the Gold Standard. The image below shows the “relentless” decline in wages compared to gross domestic product.

Translation: We are producing more economic output, but the average person is making less wages.

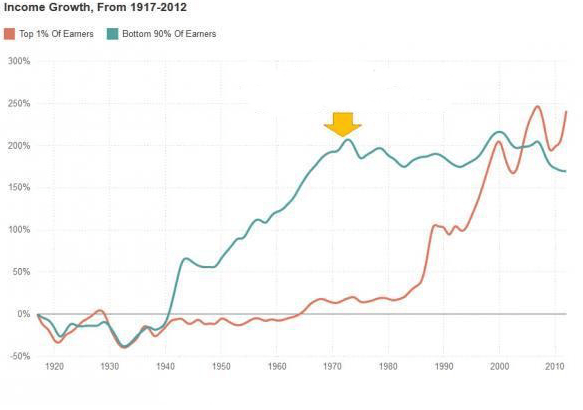

But wait, I know some people that have huge salaries!? What about them? The chart below shows income growth over the past 100 years.

You can clearly see that the top 1% has benefited from moving off the gold standard. Austrian economist Friedrich August von Hayek documented this finding, calling it the Cantillon Effect.

The Cantillon Effect displays how monetary expansion doesn’t happen evenly throughout society. those closest to the central bank’s printers disproportionately benefit the most.

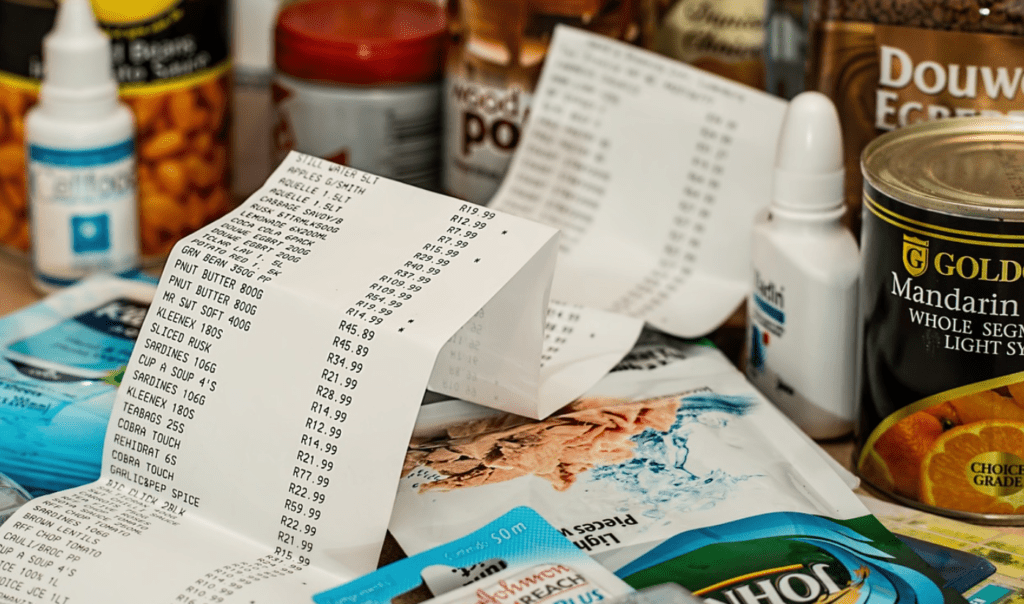

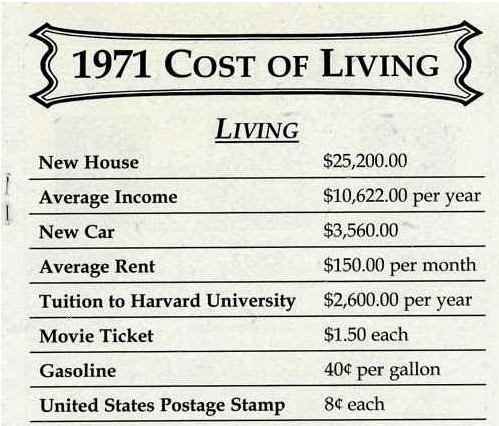

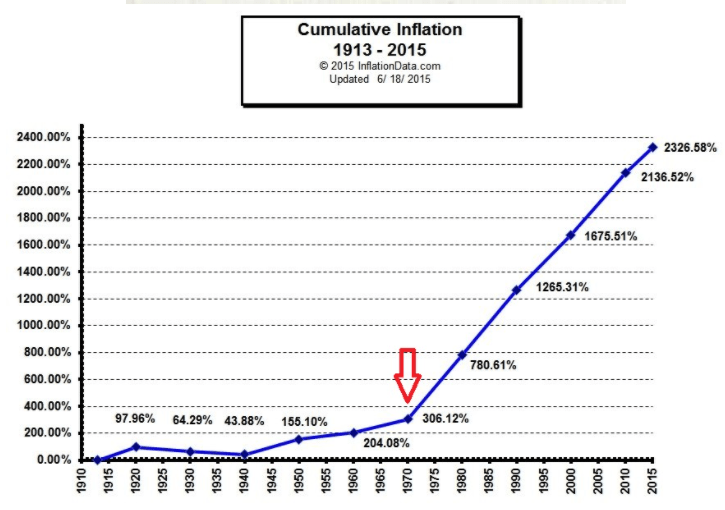

Okay, so income for the majority of people hasn’t improved in the last 50 years. What about expenses, hasn’t technology lowered expenses?

As you can see from the cumulative inflation chart below and the cost of the living table above, expenses haven’t improved for the average American either.

As the government freely debases the currency to serve their needs, the underlying value of the dollar drops resulting in inflated prices for goods and services.

Inflation serves as a hidden tax. Inflation steals the savings from the average citizen without them seeing it happen. Suddenly, you wake up and your purchasing power has decreased.

In 2020, the government working in tandem with the Federal Reserve to create massive amounts of liquidity through printing dollars to help save the economy from the lockdowns due to the Covid-19 pandemic.

This is not to serve as a political commentary on whether the actions of the Federal Reserve to create liquidity was necessary or not. Surely giving money to the restaurants, businesses, and healthcare organizations that needed it gave them a short-term benefit.

However, it is clear we are on a path that very likely will cause inflation in the months and years to come.

Regardless of recent events, the financial picture for the average American is clear. It has been more and more difficult to save money and create a life of financial freedom.

I believe the Minimalist movement is an earnest and thoughtful attempt to escape the tyranny of our fiat money system. Those who follow the principles of Minimalism find that it provides more benefits on top of the financial ones, but our financial energy often reflects our entire life.

Escaping the Rat Race

The system hasn’t set up the average citizen for success. On top of that, the media and advertising, scream at us that our lives are not complete unless we have that next ____________.

- House

- Promotion

- Car

- Phone

- Jewelry

Minimalists have found a way to opt-out of the system by saying no to the Rat Race. The Rat Rat can be defined as an endless, self-defeating, or pointless pursuit.

We’ve all been there. You get that big promotion that makes more money, but you end up being more miserable. You work more hours, pay more taxes, and sure that sweet Volvo SUV is nice, but now you need the super-charged Range Rover Sport.

The fiat money system in the last 50 years has made “the game” a lot harder all the while, the message you find on tv is you need more to keep up.

The minimalist says I’m not playing this game anymore. My time, interests, and relationships are too important to be brought into the game of constantly chasing more stuff.

The monetary policy created over the last 50 years has dis-incentivized savers. It makes more sense to constantly accrue greater levels of debt.

If you know implicitly that your savings will be worthless in the future, you would not save money, but you’d either invest in an asset or spend it.

We’ve already seen that the average wages have declined and average expenses have increased in the last 50 years. With the gap between expenses and income tightening, it makes investing in a significant way a real challenge. However, the messages you see in the media, are you need more stuff!

The Minimalist is left with one option, opt out of endless, mindless consumption and take control of your financial and mental destiny.

Bitcoin, Minimalism, and Self-Sovereignty

Enter Bitcoin.

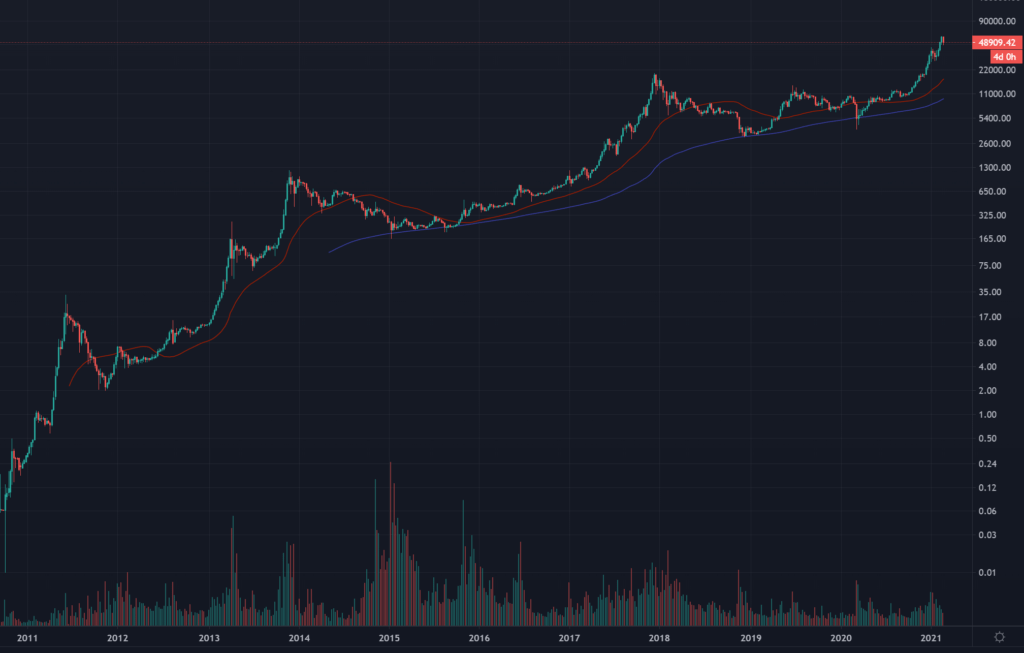

Bitcoin operates as saving technology, incentivizing the saver to not spend their money!

The Bitcoin protocol is designed to reduce scarcity over time. As the block reward continually declines, the scarcity of Bitcoin increases, resulting in the value going up.

This is the polar opposite of the fiat money system the world currently lives with. With fiat currency, the supply almost exclusively goes up and the value almost exclusively goes down!

Growing up many of us were taught that saving is a virtue. The prudent saver will have enough stored up for a rainy day. If the system goes against this principle how can it succeed?

Saving requires discipline, patience, and mindfulness.

Try Hodling Bitcoin through a bear market and you will increase all of the above!

The minimalist is attracted to the same virtues inherent in the Bitcoin protocol. It is no wonder there are many Bitcoiners that profess and practice minimalism.

After all, why would you want to spend your Bitcoin if it continues to increase in value? Is a new car as important as your time, energy, and freedom?

In order to make a decision to spend Bitcoin you would want to seriously consider if this was an item that you truly valued. Many innovations are rapidly happening in the Bitcoin community allowing users to obtain a fiat loan using Bitcoin as collateral. This would allow the holder to continue saving their hard money (bitcoin) while simultaneously spending their rapidly devalued fiat currency.

The fiat money system solidified with the Brenton Woods agreement in 1971 gave tremendous power to the governments and central banking authorities of the world, particularly in the United States.

The Bitcoin monetary system gives tremendous power back to the individual. The individual obtains self-sovereignty over their financial means with a store of value that cannot be confiscated, stolen, or devalued.

Minimalism also gives the individual self-sovereignty in their ability to live life on their own terms, pursue the things that make them most happy, and opt-out of a never-ending rat race.

Minimalists are not against having wealth or even nice things.

In fact, many minimalists apply their financial freedom to focus on only the best things, the most beautiful, and the most essential items that will bring happiness and joy into their life. Similar to a Bitcoiner who would only trade their Bitcoin for something truly valuable to their lives.

Bitcoin compliments minimalist philosophy. Both Bitcoin and Minimalism seek the same end – Freedom.

My own journey Minimalism & Bitcoin

I started becoming interested in Minimalism years ago after reading Josh Becker’s blog becomingminimalist.com. This was back in 2013, before I had heard of Bitcoin.

Something struck a cord with me. I started throwing away everything I had that was not absolutely essential. The more I threw away, or donated, the more free I become! The feeling was intoxicating.

The best part was it freed up money! I was able to investing more money simply because of the fact that I only valued what was essential.

I met my wife in 2014, she is not a minimalist. We now have two kids and that comes with a lot of extra stuff. However, my wife has quickly started to see the benefits of having a life with less and focusing on what is most essential.

Being actively involved in the investing and technology world, I stumbled across Bitcoin in 2015. Similar to the feeling I had with Minimalism, I was completely blown away by the idea. Like many in the space, once you start down the rabbit hole, you find that the depth is unfathomable.

Bitcoin links us to many of the truths found in Minimalism. Amazingly, Bitcoin also links us to other lifestyle choices like keto/carnivorous eating, weight lifting, stoicism, and Austrian Economics.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research