Do you want to take control of your finances?

While most people would quickly and enthusiastically say “Yes!” I have a feeling that the great majority of people don’t actually want to take complete control of their financial lives.

While most of the readers here are likely not in this category, most people don’t really want to take the time to understand their complete financial picture.

In some cases, this could be due to a fear of facing the truth. If you are regularly spending $6,000 a month and you make $5,000, you may not want to deal with living on less.

I remember doing a “budget” and figuring I was probably doing okay (see reason number 2). However, I couldn’t figure out exactly where all the money was going every month.

Sure I paid, the bills but I never got ahead. I didn’t invest as much as I wanted to. I didn’t go on the amazing trips I had planned. Instead, I settled every single month for just having some control of my finances.

The purpose of this blog is to help you GET AHEAD and live with complete financial freedom.

If you want 100% financial freedom you will need to take complete control of your finances. Having a “good feel” for your expenses and income streams is not going to get you the results that you desire.

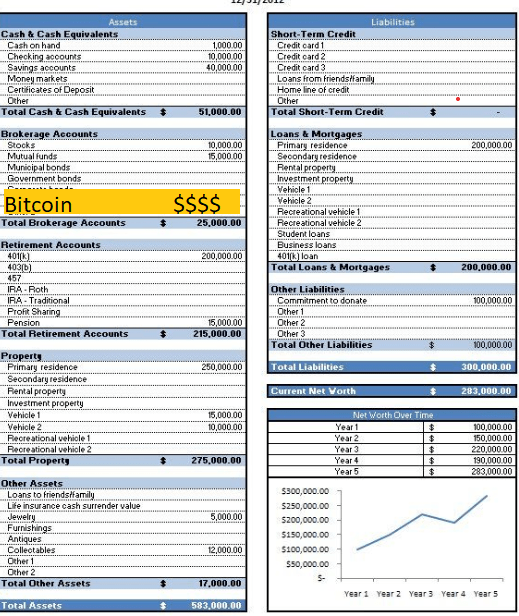

I define financial freedom as the ability to live and do what you like without having to work. By following the principles below, I was able to more than 10X my net worth in 5 years (Bitcoin helped too :)).

You start by keeping track of every penny.

When I say, every penny, I mean every penny.

I know it sounds excessive but an imprecise measurement will give you imprecise results.

When you take radical responsibility and ownership of your life, incredible things happen.

For me, it helps thinking of myself as a business. A business understands their percentage spending on each line item of the P&L. They understand how much they are contributing to future growth and how much they are spending on research and development. Businesses have a budget for the unexpected and also are willing to take risks.

While the level of honesty and responsibility it takes to record every penny may not be easy at first, the reward will pay dividends for the rest of your life.

1. Simplify your Spending

You’ll never be able to keep track of all of your money if you do not simplify your out-flows. How many methods do you have to spend money? Here are some typical methods –

- Cash Withdrawals

- Credit Cards

- Debit Cards

- ACH from your Bank Account

- Paypal

- Digital Wallets

- Prepaid Card

- Checks

- Mobile Payments (Wechat, Ali-Pay)

- Money Orders

These are just a sample of the various methods of payment that are widely used. Smart merchants make it as convenient as possible to provide an easy way to drain your bank account!

If you want to track all of your spending multiple accounts, credit cards, and payment methods make this serious challenge. This leads me to tip #1 for simplifying your finances.

Create as few payment options as possible for yourself. Aim for one-two as a goal.

I personally try my hardest to use one payment method.

I use the Chase Sapphire Reserve Card for near all of my purchasing. This card has tremendous travel perks for the type of spending I do.

Even more powerfully, anything myself (or my wife) spends is accounted for in one convenient place. I don’t need to check, combine, or filter through multiple accounts to find out how much money I spent each month.

There are several apps and online services you can use to combine your accounts and spending in one place for you. If this works for you, by all means, be my guest.

However, I believe there is something extremely valuable about doing your own accounting item by item. Additionally, the simplicity of not having to check multiple places for a various charge or purchase is extremely useful.

I know there are going to be a ton of Bitcoiners out there ready to criticize me for not using some type of cryptocurrency-based card or something linked to a digital wallet. I am open to the idea, but I have not yet found a convenient and useful card that beats the Sapphire Reserve. If you have some ideas, please let me know in the comments below!

2. Ballparking your Budget Doesn’t Work

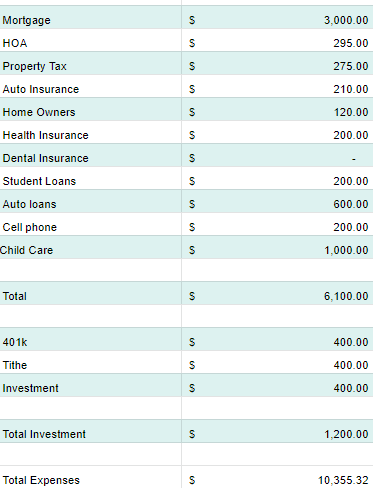

My budget used to look something like the following.

| Mortgage | $3,000 |

| HOA | $300 |

| Property Tax | $295 |

| Auto Insurance | $210 |

| Home Owners Insurance | $120 |

| Health Insurance | $200 |

| Student Loans | $200 |

| Auto loans | $600 |

| Cell Phones | $200 |

| Child Care | $1,000 |

| Utilities, TV, etc | $400 |

| Grand Total | $6,525 |

I’d say, this is great, I definitely need to have at least $6,125 per month.

If I make $10,000 I will have a nice $3,475 leftover for flexible spending!

The theory of this kind of budget is I take into account the fixed costs that I know I will have every month. Theoretically, the rest of the money is free for me to spend on whatever I choose.

The problem is this budget failed me miserably. By not taking variable expenses into, my perceived freedom actually became my failure.

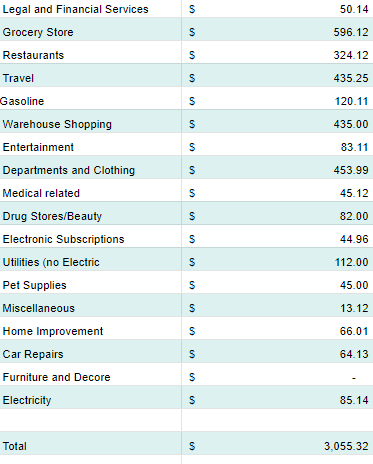

When I wanted leftover money to invest, go on vacation, or buy a higher-priced asset, the money wasn’t there. Here is what my budget looks like now.

I used fictitious numbers that I thought might be slightly above average financial statement for an American Citizen.

However, the categories are exactly the categories that I used minus a couple of specialty categories that likely wouldn’t apply to everyone. Here you can see I have very specific dollar amounts to the cent. This allows me to calculate my spending trends and know where my funds are going.

You can see in the case above, if the individual made 10,000 per month they would know they need to decrease their spending by $355.32 just to be even for the month.

The last point is this allows you to prioritize your budget and pay yourself first.

If your goal is to invest a certain amount of money per month, that needs to be the first item that comes out of your budget and not the last. This is a subtle mind shift, but an extremely important one.

Paying yourself first will allow you to prioritize the goals and dreams that matter to you while taking complete ownership of your finances.

3. The Financial Statement or P&L isn’t the Whole Picture

Perhaps the greatest benefit of counting every penny is the ability to go beyond the Profit & Loss Statement. The P&L is a great starting place, but doesn’t give you the full picture, it gives you a two-dimensional look at your finances.

The key to growing your wealth is to keep track of a personal finance balance sheet.

The balance sheet goes beyond your income and expenses and focuses on your Assets, Liabilities, and Net Worth.

Peter Drucker the famously said, “If you can’t measure it, you can’t manage it or grow it.”

Keeping track of my balance sheet has been the key to growing my net worth over the years. This enables you to allocate better, manage the P&L better, and create a strategic plan for the future.

Can you keep track of a balance sheet without keeping track of every penny?

Yes you can.

However, if you have a sloppy income statement and a semi-accurate balance sheet, you really don’t have a financial strategy.

This is where the statement of cash flows becomes and important part of the equation. The statement of cash flows determines whether you are getting richer or getting poorer.

While some tycoons out there may actually create a separate statement of monthly cash flows, if you have a detailed balance sheet and financial statement that includes every penny and is completed on a regular basis, you have all the information you need.

The statement of cash flow is so important because it determines WHERE your money is going.

A simple example of this would be to observe cash flowing into a house payment which makes your mortgage liability go down and your home equity assets go up on the balance sheet. This expense is increasing your net worth.

Alternatively, if you observe cash flowing into something like food expense, travel, or electronics, your net worth will likely be headed south.

Taking control of your finances is for many the first step toward true financial freedom. Even if you are extremely rich, failure to take control and count every penny (or pay someone to), could be the beginning of a dire financial situation. Radical ownership leads to leveling up your life in ways that will benefit you regardless of where you start.

Please read our disclaimer here regarding investment advice and risk. Disclaimer: This should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Please consult an appropriate tax or financial professional to understand your personal tax and financial circumstances. I may get compensated by some platforms mentioned below (because of referral links). Do your own research